The Dow Jones Industrial Average surged by more than 2,500 points, the Nasdaq climbed roughly 1,500 points, and the S&P 500 advanced about 400 points as U.S. markets recovered a significant portion of their recent losses. The rally followed a pivotal policy move from President Donald Trump, who announced a 90-day pause on all additional tariffs for trading partners outside China, while keeping a 10% baseline tariff intact. The decision effectively suspended the new tariffs that had just gone into effect, offering a temporary reprieve for the global trade environment while negotiations continued. The pause came amid a broad push from more than 75 countries to engage the United States in talks on trade, barriers, tariffs, currency manipulation, and non-monetary barriers, with assurances that those parties had not retaliated against the United States during the outreach. In a post on Truth Social, Trump stated that he had authorized the 90-day pause and a substantially lowered reciprocal tariff of 10% during this period, noting that any reciprocal actions would be avoided in the interim. The move signaled a strategic pause intended to buy time for diplomacy and recalibration of tariff policy in the months ahead.

Treasury Secretary Scott Bessent confirmed the administration’s stance, telling reporters that the decision took “great courage” to stay the course up to this moment and emphasizing that the United States would not retaliate during the pause; the message, according to Bessent, is that non-retaliation will be rewarded. He also indicated that the negotiations are expected to unfold gradually and that the president intends to stay personally involved in guiding the discussions. NPR reported these remarks as part of the broader narrative surrounding the tariff pause and the ongoing negotiations. In the meantime, the markets reacted with a strong relief rally, reflecting investor relief that the immediate risk of a rapid escalation in tariffs might be tempered by a deliberate negotiating process.

Yet the policy move did not eliminate all trade frictions: while the 90-day pause applied broadly to most partners, Trump chose to maintain, and even escalate in one case, tariff actions against China. The administration raised the tariff rate on Chinese goods to 125% from 104%, a move framed by officials as a necessary response to what was characterized as China’s ongoing, “lack of respect” for world markets. China, in turn, raised its own tariffs on U.S. imports to 84%, signaling a tit-for-tat dynamic that maintained an elevated tariff posture even as talks continued with other trading partners. The combination of a pause for most partners and heightened pressures on China created a complex policy tableau, one that investors weighed as they assessed potential trajectories for global trade and economic growth. In the immediate wake of the policy announcements, markets surged: the Dow Jones Composite index rose by more than 2,500 points, the Nasdaq advanced roughly 1,466 points (about 9.7%), the S&P 500 gained about 387 points (roughly 7.8%), and the Russell 2000 jumped about 150 points (around 8.5%). These moves represented the strongest one-day gains for the major indices since 2020, marking a dramatic shift in sentiment after a period of heightened trade tensions and market volatility. While the relief rally was pronounced, the underlying policy picture remained in flux, with substantial tariffs still in place on China and a broader 10% baseline tariff structure maintained for other trading partners. The market reaction captured a moment of renewed optimism among investors, even as they acknowledged the ongoing policy uncertainty that would continue to shape price discovery and risk assessment in the weeks and months ahead.

Original narratives around the policy shift had framed the pause as a strategic window for diplomacy, enabling the United States to press for reforms in trade practices without triggering immediate retaliatory cycles from other major economies. The 90-day duration was presented as a defined period in which Washington and its partners could pursue a negotiated settlement on topics including trade barriers, tariff structures, currency practices, and the broader architecture governing non-monetary trade barriers. The administration’s position suggested that this pause would allow for a recalibration of relationships and an opportunity to test the resolve of partners to engage in meaningful dialogue. The stated objective appeared to be reducing immediate tariff pressure while pursuing longer-term structural changes in the global trade framework. For investors, the central question remained whether the pause would translate into durable policy normalization or whether it would be followed by renewed tariff threats or escalations, particularly in areas where US-China tensions remain most acute.

Tariffs Boosted on China, Policy Details, and Market Implications

In a parallel development that underscored the bifurcated nature of the administration’s tariff posture, China’s own tariff responses added another layer of complexity to the policy landscape. The United States increased tariffs on Chinese goods to 125% from 104%, signaling a tougher stance in response to perceived policy frictions or disputes. The U.S. move was accompanied by a contemporaneous action from China, which raised its tariffs on U.S. imports to 84%, signaling a reciprocal tightening that reinforced tensions in bilateral trade. The Trump administration framed the 125% U.S. tariff as a corrective measure tied to China’s behavior on the world stage and its alleged pattern of “ripping off” the United States and other nations. The post on Truth Social conveyed a sense of resolve to maintain questioning and pressure on China, even as other partners faced temporary tariff relief.

Against this backdrop, market participants interpreted the 90-day pause as a potential opening for negotiated outcomes with non-Chinese partners, coupled with a firm stance toward China that signaled Washington’s willingness to leverage tariffs as a bargaining tool. The immediate market response—a powerful rally across the major indices—suggested that investors welcomed the pause as a reprieve from full-scale tariff escalation, along with the expectation that any future agreement could address core concerns such as market access, technology transfer practices, and currency considerations. However, the concurrent escalation of tariffs on China highlighted the fragility of any perceived stabilization in global trade policies and underscored the possibility of continued volatility should trade talks stall or falter in the face of domestic and international pressures.

The market’s initial reaction to the policy mix reflected a blend of relief and caution. While the outright removal of new tariffs for the next 90 days would likely reduce near-term cost pressures for many companies and investors, the persistence of tariffs on China and the ongoing risk of new measures or retaliatory actions created a persistent underlying risk. The gains on the day signaled relief that the immediate threat of a tariff extension or sudden escalations might be tempered, but the longer-term trajectory for trade policy remained deeply uncertain. Investors would likely monitor several key indicators in the weeks ahead: the pace and substance of negotiations with partner countries outside China, the evolution of U.S.-China talks and any potential breakthrough or breakdown, and the responses of global markets to continued tariff shocks or conciliatory steps. The interplay between a broad-based pause and targeted actions against China created a nuanced policy signal, one that offered short-term relief while leaving open meaningful questions about long-term economic implications for supply chains, investment decisions, and global growth.

Policy Statements, Negotiations, and the Road Ahead

At the core of the policy narrative was a set of statements from U.S. officials and a public posture that framed the pause as a carefully calibrated step toward broader negotiations. The administration emphasized that more than 75 countries had engaged U.S. representatives—encompassing agencies such as the Department of Commerce, the Treasury, and the United States Trade Representative—to seek solutions on trade-related subjects. These discussions aimed to address concerns around trade barriers, tariffs, currency manipulation, and non-monetary tariff practices, with the understanding that retaliation had, thus far, been avoided at the strong urging of the President. The 90-day pause was described as a temporary, reciprocal reduction in tariffs—set at 10%—to facilitate ongoing talks and to foster an environment in which more constructive negotiations could unfold without immediate escalation.

The public messaging from Treasury and White House officials stressed that the negotiations would require time and careful diplomacy. The charge to stay the course—while remaining personally involved at the highest levels—was presented as a deliberate strategy to build confidence among trading partners and to create a framework in which substantive concessions could be negotiated. The accountability mechanism implied by the pause was that, should talks progress, tariffs could be recalibrated in a manner that reflected mutual gains or adjusted to new market realities. The upward pressure on China’s tariffs, however, signaled that any agreement would still need to address core concerns related to China’s trade conduct and its impact on global markets. In sum, the policy blueprint established by the administration communicated a dual-track approach: relief and negotiation with most partners, coupled with a firm, punitive posture toward China until a more comprehensive understanding could be reached.

Investor Outlook, Market Dynamics, and Sectoral Considerations

From an investor perspective, the rapid market rally that followed the tariff announcements underscored the complex dynamics that emerge when policy is perceived as balancing flexibility with firmness. The immediate uplift in equity prices suggested that investors viewed the pause as a meaningful de-escalation in near-term risk, at least for non-Chinese trading partners. The magnitude of the gains across the Dow, Nasdaq, and S&P indicated broad-based buying interest, with particularly strong participation from segments sensitive to macro policy shifts and global trade expectations. The Russell 2000’s notable rise highlighted renewed optimism among small-cap equities, which often respond more acutely to changes in trade policy and the prospect of improved corporate profit visibility.

In terms of sectoral impact, higher tariffs on China could have mixed implications for different industries. Some exporters and manufacturers with strong exposure to Chinese markets might face increased costs and supply-chain pressures, potentially weighing on earnings if the costs cannot be fully passed through to consumers. Conversely, sectors that stand to benefit from relief in other trading partners or from a perceived stabilization in overall trade relations could see improved sentiment and investment inflows. The absence of new tariffs for the majority of trading partners might also support consumer- and technology-related shares, assuming that improved trade conditions translate into steadier revenue streams and fewer supply-chain disruptions. Yet the persistence of elevated tariffs on China and the ongoing risk of renewed tariff actions kept the market attentive to evolving news, ensuring that gains would be subject to reassessment as negotiations progressed.

Global Market Reactions and Currency Movements

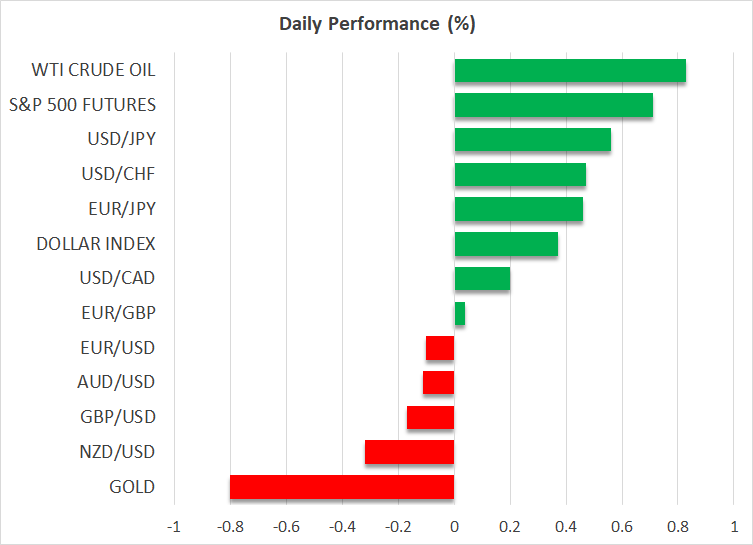

The broader global market reaction to the tariff pause and China-related tariff actions was multifaceted. While the immediate focus centered on U.S. equity performance, investors around the world considered the potential spillovers into foreign exchange markets, commodity pricing, and international capital flows. A more favorable risk environment in the United States often translates into strength for U.S. assets and can influence currency dynamics, potentially supporting the dollar in uncertain times and pricing in higher return expectations for U.S. equities. Meanwhile, the China-related tariff stance could provoke adjustments in Chinese equities and surrounding markets as market participants reassess the policy risk and the feasibility of any imminent rapprochement with the United States.

The policy environment’s complexity also meant that investors would be watching for clarity on the timeline and milestones for negotiations. If talks move forward constructively, the balance of risks could shift toward a more constructive outlook for global growth and investment. If negotiations stall or deteriorate, the market could experience renewed volatility, with the possibility of tariff movements re-emerging and the potential for countermeasures from other trading partners. In this context, traders and institutions may seek hedges or diversify exposures to mitigate potential downside risk while maintaining exposure to the prospect of long-term policy stabilization.

Economic Context, Risks, and Forward-Looking Considerations

Beyond the immediate policy shifts and market reactions, the tariff pause and China tariff actions sit within a broader economic landscape characterized by ongoing trade frictions and geopolitical considerations. The pause’s intent appears to be to reduce near-term cost pressures, de-risk supply chains, and create a window for substantive negotiation. Yet the broader implications for investment, manufacturing, and global growth depend on the durability and depth of any forthcoming agreements, as well as the ability of different parties to implement reforms and maintain compliance with new terms. In this sense, the policy move is not a final settlement but a strategic opening that could influence corporate planning, capital expenditure decisions, and cross-border collaboration over the coming months.

Investors must also consider the potential for policy reversals or extensions. The 90-day window provides a finite horizon in which to gauge whether negotiations can yield meaningful concessions that would reduce the need for broad-based tariff protections. If negotiations fail to yield tangible progress, the likelihood of renewed tariff threats could rise, prompting renewed risk-off behavior or selective sector rotations as market participants reassess earnings expectations and cost structures. The possibility of additional policy announcements in response to evolving economic data, trade negotiations, and domestic political considerations further underscores the need for a measured, information-driven approach to portfolio management during this period of heightened policy uncertainty.

Conclusion

In sum, the day’s developments marked a significant inflection point in the ongoing tariff and trade policy narrative. The Dow, Nasdaq, and S&P 500 posted substantial gains, reflecting investor relief at a temporary pause in tariff escalation for most trading partners while acknowledging the continued tensions with China. President Trump’s 90-day pause, combined with the continuation of a 10% baseline tariff and the intensified tariffs on China, created a dual path: a brief reprieve for a broad set of partners coupled with a tougher stance toward China. The move was accompanied by strong rhetoric from the President, including a Truth Social post detailing the pause and the accompanying rationale tied to ongoing negotiations and global market considerations. Treasury Secretary Bessent’s remarks reinforced the administration’s intent to pursue a negotiated solution while signaling that time and patience would be essential to achieving a durable agreement. The immediate market response was a reminder of the delicate balance between policy signaling and actual economic outcomes, as investors weighed the potential for lasting improvements in trade relations against the persistent risks posed by China-related tariffs and broader tariff dynamics.

As the policy landscape continues to evolve, market participants are likely to monitor the pace of discussions with partner countries, the trajectory of U.S.-China negotiations, and the substance of any concessions or reforms that could alter the tariff calculus. The coming weeks will be shaped by bargaining dynamics, macroeconomic indicators, and real-world implications for global supply chains, company profitability, and consumer prices. Investors, businesses, and policymakers alike will be paying close attention to the extent to which this pause translates into measurable improvements in trade flows, market confidence, and long-term economic growth. In the near term, the balance of optimism and risk will hinge on how effectively the pause is converted into substantive negotiations, how China responds to the tariff decisions, and how resilient the global economy proves to be in the face of ongoing trade tensions.