A new wave of market forecasting is reshaping how traders think about timing and price movement. Rather than accepting the familiar lag of traditional moving averages, today’s forecasting methods are being redesigned to become more predictive by weaving intermarket data and advanced artificial intelligence into the core calculation. This shift aims to provide traders with a clearer edge during periods of uncertainty or heightened volatility, enabling smarter entry and exit decisions. By reimagining moving averages as forward-looking tools, the industry is moving toward a model where timing is informed by a broader constellation of signals rather than a single market in isolation.

Rethinking Market Forecasting: Moving Averages, Intermarket Data, and Artificial Intelligence

The challenge with conventional moving averages has always been its lag. Moving averages smooth price action by averaging past prices over a defined period, which helps traders identify trends and reduce noise. But lag comes at a cost: by the time a traditional moving average confirms a trend, a portion of the move may have already occurred, and profits can slip away. In today’s fast-moving markets, this delay can be detrimental, especially when quick reaction to changing conditions is essential. To address this, professionals are exploring how to retool moving averages so they not only reflect historical data but also anticipate near-term movements. The goal is to transform a widely used indicator from a retrospective signal into a proactive predictor that informs decisions before the bulk of the move unfolds.

A central idea behind this transformation is to expand the data inputs used in calculating moving averages beyond a single market’s price history. Intermarket data—information drawn from related markets, asset classes, or macro variables that historically interact with the primary market—offers a richer context. When intermarket relationships are properly integrated, the resulting indicators can capture how shifts in one market tend to precede or accompany changes in another. For instance, commodity prices, currency movements, bond yields, and equity sector rotations can collectively inform the likely direction of a stock or index. The approach is to construct a forecasting framework where the moving average is informed by patterns that cross market boundaries, thereby increasing the probability that the signal reflects not just what happened, but what is likely to happen next.

Neural networks are a mathematical tool well-suited to this task because they excel at recognizing complex, nonlinear relationships among many inputs. In a market forecasting context, neural networks are trained on historical data that include the primary market’s price series along with intermarket indicators, macroeconomic signals, and other relevant variables. Through a learning process, the network identifies hidden patterns—subtle interactions, delays, and feedback loops—that a traditional model might miss. The outcome is a model that can generate moving-average-like signals that are informed by a broad spectrum of information and that adapt as intermarket dynamics shift. In effect, neural networks act like a computational brain that learns how multiple markets relate to one another and how those relationships evolve over time.

The practical upshot is the emergence of leading indicators built from predicted moving averages. By blending intermarket signals with machine-learned relationships, the resulting tools can anticipate price movements rather than merely confirm them after the fact. This transition from lagging to leading indicators is particularly valuable in markets that experience abrupt shifts in sentiment or liquidity, where early signals can materially improve timing. A leading indicator has the potential to provide a one-day or several-day lead on a trend’s direction, creating more opportunities to enter at favorable prices and to exit before a reversal erodes gains. Such capability matters when confidence is fragile or volatility is high, because it helps traders act with greater conviction rather than waiting for a late-stage confirmation.

A notable aspect of this approach is the integration of nonlinear patterns that often escape standard linear models. Neural networks can capture how intermarket forces interact in complex ways, such as how a currency move might amplify or dampen a stock’s price response, or how shifting yields influence sector leadership. This richness of information is then distilled into a refined signal—an evolved moving-average concept—that smooths the price trend while remaining sensitive to shifts in the underlying market structure. The result is a more nuanced, timely, and robust indicator that aligns with the realities of modern trading environments.

The practical benefits people seek from this technology are tangible. Traders can gain a short-term edge by receiving a signal that points toward the likely trend direction one to three days ahead of the broad price move. This lead time supports more precise entry and exit decisions, enabling positions to be managed with improved precision and confidence. In many cases, these tools claim to offer a high degree of predictive accuracy for short-run movements, with reported performance metrics suggesting substantial improvements over traditional methods. While any claims of predictive precision must be evaluated independently, the core concept remains powerful: a well-constructed, AI-enhanced moving average that accounts for intermarket dynamics can help traders stay ahead of momentum shifts rather than chasing them after the fact.

This innovative approach is embodied in products and platforms designed to harness neural networks and intermarket analysis to produce Predicted Moving Average tools. These tools leverage the computational strengths of artificial intelligence to interpret a broad data landscape and translate it into actionable signals. The emphasis is on creating a smoother price trend that still preserves sensitivity to imminent turns in market direction, delivering a balanced blend of stability and responsiveness. For traders, this translates into clearer signals, reduced noise, and potentially more reliable timing in both uptrends and downtrends. In short, the evolution of market forecasting is moving beyond the single-market, backward-looking paradigm to a more interconnected, forward-looking framework that uses AI to decipher and anticipate price dynamics.

Patented and tested methods in this space have claimed impressive results, including the ability to obtain a notable jump-start on trend direction—potentially one to three days earlier than traditional indicators would signal. Such lead times can translate into more precise entries, more favorable exit points, and an overall enhancement in the risk-reward calculus of short-term trading strategies. While it is essential to approach any performance claims with due diligence and to conduct independent verification, the underlying mechanism—combining neural networks with intermarket data to produce predictive moving averages—offers a credible path toward more proactive market forecasting.

In this landscape, traders are increasingly looking to the experiences of peers who have adopted these technologies. Testimonials and user feedback often highlight improvements in timing accuracy, smoother signal generation, and a greater sense of control over trade decisions. The emphasis remains on the practical value: better alignment between signal generation and the realities of price dynamics, especially in environments characterized by volatility and rapid shifts in market leadership. For those who seek a structured, data-driven approach to forecasting, the convergence of moving averages, intermarket data, and neural networks represents a compelling evolution in how we forecast and trade.

Practical Deployment: From Theory to Trading Floor

Turning theory into practice requires a clear framework for data collection, model training, signal generation, and risk management. At the core is the Predicted Moving Average concept, which merges neural networks with intermarket analysis to produce a refined signal that informs short-term trading decisions. The design intent is to smooth the price trend while maintaining sensitivity to upcoming directional changes, yielding a tool that can support more disciplined trading decisions in real time. In application, this approach involves several interconnected steps, each contributing to the reliability and usefulness of the final signal.

A structured workflow begins with data ingestion. Traders gather price histories for the target instrument alongside a curated set of intermarket indicators, such as related asset prices, currency moves, commodity prices, yield curves, and macroeconomic indicators. The data must be cleaned, synchronized, and normalized to ensure consistency across inputs, as misaligned or noisy data can degrade a model’s performance. Once the data pipeline is established, the neural network is trained to learn the relationships between the target market’s price movements and the intermarket signals. Training involves adjusting a wide array of parameters to minimize prediction error, with the model learning to weigh different inputs according to their historical predictive power. The training process is iterative and requires rigorous validation to prevent overfitting, ensuring the model performs well on unseen data.

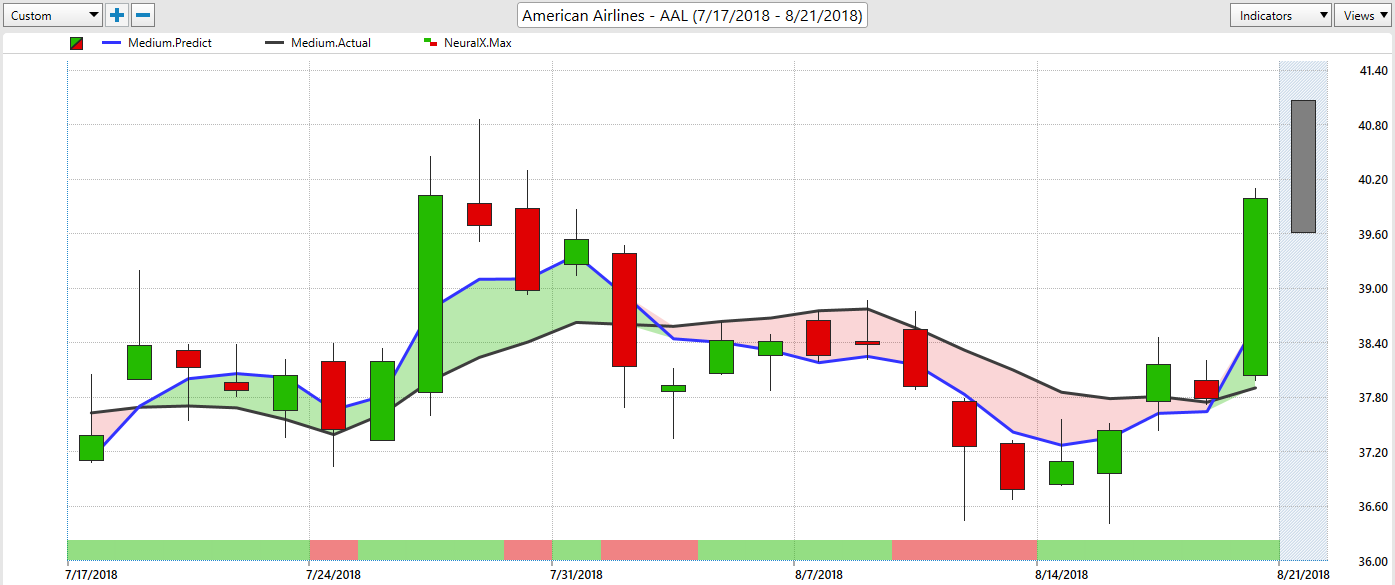

After a robust training phase, the system produces Predicted Moving Average signals. These signals translate the complex, multi-input output of the neural network into a practical trading cue that resembles a moving average but carries the benefit of intermarket awareness. Traders can then integrate these signals into their existing trading workflow. This integration often involves overlaying the Predicted Moving Average on price charts, pairing it with traditional indicators for confirmation, and applying predefined rules for entries, exits, and risk management. The objective is to use a leading indicator as a guide for trade timing, rather than as a sole decision-maker, ensuring that risk controls remain intact and that exposure aligns with individual strategies and risk tolerance.

A critical aspect of deploying AI-enhanced moving averages is understanding the role of intermarket data. By examining how different markets interact—with cross-market momentum shifts, correlations, and contagion effects—traders gain an expanded perspective on what may drive price moves next. For example, shifts in currency values can influence equity prices through import/export dynamics, while commodity price changes might signal broader macroeconomic trends. Including these signals helps the model capture a more comprehensive picture of the forces shaping price action. It also provides resilience: when one data stream becomes less reliable, others may compensate, maintaining the robustness of the signal set. The emphasis remains on practical utility: actionable, timely insights that help traders act with improved precision and confidence.

In the day-to-day trading workflow, Predicted Moving Averages are often used in conjunction with other signals and risk-management tools. Traders may employ a layered approach that uses the AI-driven indicator as a primary timing signal, supplemented by secondary confirmations such as volume spikes, price action patterns, or momentum metrics. This multi-faceted framework reduces the likelihood of acting on a false signal and can help preserve capital during periods of noise or churn. The ultimate aim is to improve timing without sacrificing discipline, ensuring that decisions are anchored in data-driven insights while respecting the trader’s risk framework and capital allocation guidelines.

The practical impact on trading performance hinges on several factors, including the quality of data inputs, the sophistication of the neural network, the stability of intermarket relationships, and the trader’s ability to interpret and apply the signals effectively. When these elements align, the AI-enhanced moving average approach can lead to clearer trend signals, more timely entries, and better exit strategies. It can also foster a more proactive trading mindset, where anticipation of near-term movements informs positions rather than reaction to completed moves. The goal is not to eliminate risk but to improve the odds of successful trades by leveraging a richer information base and smarter pattern recognition.

Traders adopting this technology often report improvements in confidence when timing decisions, particularly in markets characterized by rapid swings and discordant signals. The ability to forecast short-term direction with a lead time—potentially one to three days—can help traders align their risk exposure with anticipated price dynamics, enabling more precise position sizing and better use of stop placements. The combination of intermarket analysis and neural networks contributes to a forecasting framework that deserves careful evaluation, backtesting, and incremental adoption within a broader trading plan. While past performance is not a guarantee of future results, the integration of predictive moving averages represents a meaningful evolution in how traders approach market timing, risk management, and overall strategy.

In practice, it is essential to approach AI-enhanced moving averages with a disciplined mindset. Traders should conduct thorough due diligence, perform independent backtesting across multiple market conditions, and monitor ongoing performance as market dynamics evolve. The goal is to ensure that the model remains robust, adaptable, and aligned with the trader’s objectives. By combining systematic data-driven signals with sound risk management, traders can harness the potential of predictive moving averages to support more informed decisions and a more resilient trading approach.

Building a Lead on Trends: Why Intermarket Signals Matter

The core advantage of incorporating intermarket signals lies in recognizing how different markets exert influence on one another. A movement in one asset class can provide early clues about impending moves in another, and neural networks are well-suited to decipher these relationships. By analyzing price action across markets, the forecasting framework can reveal patterns such as leading behavior in one market preceding a shift in another, or a delayed reaction that creates windows of opportunity for timely action. This interconnected view helps reduce reliance on any single data source, distributing informational weight across a network of signals that collectively describe market dynamics more comprehensively.

In addition to intermarket data, the neural network approach brings the capacity to capture nonlinear dependencies—relationships that do not follow straight lines or simple correlations. Markets interact in ways that produce feedback loops, regime changes, and nonlinearly amplified effects that traditional models might overlook. The AI-driven method adapts to these complexities by learning how different inputs interact under varying conditions. This adaptability strengthens the reliability of the resulting signals, particularly during regime shifts or periods of heightened volatility when simplistic models tend to struggle. The practical result is a more flexible and resilient forecasting framework that can respond to changing market regimes while maintaining a focus on actionable timing.

Industry practitioners emphasize that while such systems enhance timing, they do not replace sound trading discipline. The most successful implementations combine predictive signals with robust risk controls, clear trade rules, and a structured approach to position sizing. This balanced perspective helps ensure that predictive moving averages serve as tools that augment judgment rather than substitute it. In this light, the technology becomes a powerful ally that complements risk management practices and emphasizes thoughtful, planned action over reactive, emotionally driven decisions.

The movement toward AI-powered moving averages also calls for ongoing evaluation. Markets evolve, data quality varies, and correlations shift over time. Therefore, practitioners must maintain a dynamic approach to model maintenance, including regular recalibration, performance reviews, and scenario testing that covers a wide range of market conditions. The emphasis is on sustained quality and continuous improvement, ensuring that the predictive capability remains relevant and reliable as new data and market behavior emerge. When managed carefully, this ongoing stewardship supports long-term value and a more confident, systematic trading process.

Practical Deployment: From Theory to Trading Floor

Bringing the concept from the lab to the trading floor involves careful planning, execution, and ongoing refinement. The first step is to establish a dependable data pipeline that collects, cleans, and synchronizes price data from the target market and a diverse set of intermarket indicators. Data quality and timing are critical: any delays, gaps, or inconsistencies can erode the predictive integrity of the neural network and the reliability of the moving-average signals. After data handling, the model training phase begins. This phase requires defining the network architecture, selecting input features, and choosing appropriate training methodologies to minimize error while mitigating the risk of overfitting. The outcome is a network that learns to map a broad spectrum of intermarket information into a coherent, forward-looking signal that resembles a moving average but with enhanced predictive power.

Once the model demonstrates stable performance on validation data, its outputs are translated into trading signals suitable for real-time use. The Predicted Moving Average is presented as a smoothed signal that reflects anticipated price movement, rather than a backward-looking trend line alone. Traders can visualize this indicator on price charts alongside traditional tools to assess alignment, divergence, and confirmation. The practical workflow also involves integrating the AI-driven signal into a broader decision framework that includes position sizing, risk limits, and predefined criteria for entering, exiting, or adjusting trades. This layered approach helps ensure that AI-enhanced signals are used judiciously and in a way that complements a trader’s existing process.

The intermarket perspective remains a cornerstone of practical deployment. By continuously evaluating how different markets interact, traders gain a richer understanding of the forces shaping price action. For example, shifts in macroeconomic expectations, monetary policy signals, or commodity price changes can alter intermarket relationships and affect the predictive value of the signals. Maintaining awareness of these relationships enables traders to adjust their interpretations and expectations accordingly, preserving the relevance of the AI-enhanced moving averages across changing market regimes. The end goal is a trading workflow that leverages neural networks and intermarket data to provide timely, actionable insights while preserving discipline and risk control.

In addition to signal generation, robust validation and monitoring processes are essential. Traders should establish performance benchmarks, track real-time signal accuracy, and perform periodic backtests to verify that the AI-driven indicators maintain their edge. An iterative approach—where feedback from live trading informs model updates and input selection—helps keep the system aligned with current market dynamics. The result is a practical, scalable framework that can be integrated into a trader’s routine, enabling more precise timing decisions and a stronger overall trading plan.

Case for Short-Term Trends and Risk Management

For short-term traders, the combination of intermarket analysis and neural networks offers a structured pathway to align timing with evolving price patterns. The lead time offered by a predictive moving average signal can translate into more precise entries, quicker exits, and better capital efficiency. However, with any predictive technology, risk management remains a critical priority. Traders must ensure that the signals are used within a clearly defined risk framework, with stop losses, profit targets, and position-sizing rules that reflect the trader’s tolerance and objectives. The strength of this approach lies not in a single signal, but in a coherent system where AI-driven insights inform an executable plan grounded in risk discipline and adaptability.

The capacity to smooth price trends while preserving sensitivity to near-term changes makes Predicted Moving Averages a compelling option for traders seeking a balanced approach to timing. By combining AI-driven forecasts with intermarket awareness, traders can enhance their ability to anticipate moves while maintaining a structured risk posture. The ultimate value proposition is an improved trading process that supports more informed decisions, more consistent execution, and a stronger alignment between market signals and actual trades.

Intermarket Data in Action: A Holistic View of Market Dynamics

Intermarket data affords traders a broader lens through which to view market dynamics. When signals from multiple markets reinforce one another, the probability of a meaningful move increases. Conversely, discrepancies across markets can warn of potential pullbacks, reversals, or shifting leadership. Neural networks enable the system to capture these complex patterns and adapt to changing relationships over time. The net effect is a forecasting approach that remains sensitive to the multifaceted nature of markets, rather than being tethered to a single data stream.

In practice, traders may use intermarket-informed moving averages to confirm or question directional bets. A strong alignment between the Predicted Moving Average and price action across related markets can boost confidence in a trade, while divergence might prompt a more cautious stance or a search for alternative setups. This dynamic and integrated view supports thoughtful decision-making and can help traders manage risk more effectively by aligning positions with a broader set of market signals.

The broader implication for market forecasting is a shift toward systems that learn from a wide array of information sources, adapt to changing relationships, and present interpretable, actionable signals. While the technology relies on sophisticated algorithms, the overarching objective remains clear: to improve the timing and quality of trading decisions in a disciplined, data-driven manner. In this context, Predicted Moving Averages represent a meaningful step toward more accurate short-term forecasts that reflect the interconnected reality of modern markets.

Risks, Limitations, and Considerations

Despite the promise of neural networks and intermarket data, it is essential to acknowledge the potential limitations and risks associated with AI-enhanced forecasting. Model performance is highly dependent on data quality, input selection, and the stability of relationships across markets. If data quality deteriorates, or if intermarket correlations weaken, the predictive power of the signals can erode. Traders must implement rigorous data governance, continuous monitoring, and regular recalibration to maintain the integrity of the forecasting system. The risk of overfitting—where a model performs well on historical data but poorly on new data—remains a concern and requires careful validation, cross-validation, and out-of-sample testing.

Another consideration is the reliance on proprietary methods and patented science. While such technology can yield competitive advantages, traders should approach with a healthy degree of due diligence, including independent verification, replication where possible, and transparent assessment of performance across diverse market conditions. The importance of backtesting across multiple regimes cannot be overstated; it helps ensure that the model’s predictive ability is not simply a reflection of past conditions but has resilience in future scenarios. Traders should prepare for periods of underperformance and maintain flexibility to adjust their strategies in response to evolving market dynamics.

Liquidity considerations and slippage are practical realities that can affect the realized benefits of AI-driven signals. Even when a predictive signal correctly identifies a trend, execution challenges can impact entry and exit performance. Traders must integrate robust execution strategies, minimize market impact, and consider latency in data delivery and signal generation. A well-rounded approach combines predictive signals with disciplined execution, cost awareness, and a clear plan for risk management. This ensures that the advantages of a leading indicator translate into tangible trading results rather than theoretical gains.

Ethical and regulatory considerations also deserve attention. As AI-driven forecasting becomes more prevalent, traders should remain compliant with applicable trading rules and ensure that data usage aligns with regulatory expectations. Maintaining transparency in risk disclosures, model limitations, and performance reporting is important for responsible trading. Adhering to best practices and maintaining a clear line of accountability helps ensure that AI-enhanced strategies contribute to a well-regulated and sustainable trading environment.

Operational risk is another factor to consider. Systems can fail, data feeds can be interrupted, or software can encounter bugs. Having robust redundancy, failover procedures, and solid incident response plans minimizes downtime and protects trading performance. Regular maintenance windows, scheduled updates, and contingency measures should be built into the operational framework to prevent disruptions from compromising the forecasting system. The combination of solid technology, disciplined process, and proactive risk management is essential to maximizing the real-world value of predictive moving averages.

In summary, while neural networks and intermarket data offer a powerful path toward more predictive market forecasting, their successful deployment depends on careful design, rigorous validation, and disciplined risk management. Traders who adopt a thoughtful, data-driven approach—one that emphasizes data quality, model robustness, execution discipline, and regulatory awareness—are best positioned to translate AI-enhanced signals into meaningful trading advantages. The promise is clear: a more proactive, informed approach to timing that respects the complexities of modern markets and the realities of trading.

Conclusion

The evolution of market forecasting signals a fundamental shift in how traders approach timing, risk, and opportunity. By reengineering moving averages to incorporate intermarket data and to leverage neural networks, the traditional lagging indicator is transformed into a leading, predictive tool. This approach embeds artificial intelligence at the core of the signal-generation process, enabling the extraction of hidden patterns and the anticipation of near-term price movements across multiple markets. The practical implications are meaningful: traders can gain an early read on trend direction, potentially one to three days ahead, which supports more precise entries, better exits, and improved risk management. In this framework, intermarket relationships become a source of additional signal strength, enriching the traditional view of price action with a wider, more interconnected perspective.

The deployment of Predicted Moving Averages blends neural network learning with carefully curated intermarket data to produce a smoothed yet responsive indicator. This balance—smoothness to reduce noise and responsiveness to new information—helps traders navigate periods of low confidence or high volatility more effectively. The emphasis on practical workflow, robust validation, and disciplined risk controls ensures that the technology remains a tool to augment judgment rather than replace it. In practice, the improved timing and more informed decision-making can translate into a more resilient trading strategy and a clearer path toward achieving trading goals.

For traders, the message is one of opportunity and caution: opportunity in the potential for enhanced timing and decision quality, and caution in recognizing the limits of any predictive model. Independent evaluation, ongoing monitoring, and adherence to a comprehensive risk-management framework are essential. As AI-driven market forecasting continues to mature, the integration of neural networks with intermarket analysis may become increasingly central to how traders interpret the dynamics of price action and manage risk in the modern market landscape. This evolution promises to sharpen the timing of trades, deepen the analytical perspective, and support more systematic, data-driven trading practices that align with the realities of global markets.