The dollar weakened as investors weighed a step forward in President Trump’s expansive tax-cut and spending plan against looming questions about the bill’s impact on the U.S. debt trajectory. Treasuries moved in opposite directions, with the 30-year yield rising to its highest level since November 2023, while stocks closed lower and safe-haven assets like gold advanced. Oil retreated as the market absorbed fresh signals of diplomacy between the United States and Iran, set against a backdrop of renewed expectations for central-bank policy moves and mixed PMI data. The day also saw a surge in demand for alternative assets such as bitcoin, reflecting a broader search for hedges against a potentially more volatile U.S. fiscal and monetary landscape. In short, markets balanced hopes of policy stimulus against the costs of higher indebtedness, while investors sifted through crosscurrents in global growth signals, geopolitical risk, and the evolving tempo of central-bank easing.

Dollar, Treasuries, and the Debt Trajectory

The U.S. dollar extended its slide on Wednesday as market participants priced in mounting fiscal concerns arising from the House’s advancement of President Trump’s tax-cut and spending package. A Republican-controlled House committee approved the bill, setting the stage for a broader vote as soon as today, before the proposal heads to the Senate where further debates are likely. This procedural progress renewed focus on the bill’s potential to dramatically reshape the federal fiscal outlook, with critics warning of substantial increases to the national debt. The immediate market reaction reflected those concerns: a broad-based withdrawal from U.S. assets as investors reassessed the risks and the longevity of the fiscal stimulus’s benefits.

Beyond the immediate step in the legislative process, the broader risk to debt sustainability remains a central theme. Historical context matters here: the plan is associated with a projection that it would add roughly $4 trillion to the U.S. debt over the next decade. That figure weighs on confidence about the government’s ability to manage deficits in a period of already stretched fiscal space. The downgrade of the U.S. government’s credit rating—an event that had already unsettled investors in previous cycles—hung over today’s trading as a reminder of the tangible consequences of rising indebtedness. Against this backdrop, investors have shown a willingness to unwind some of their more aggressive bets on U.S. assets, with the dollar’s decline signaling a shift toward other currencies as well as the appeal of non-U.S. investments.

A striking feature in today’s market moves was the divergence between the dollar and long-term Treasury yields. The U.S. dollar fell against major peers as concerns about the debt trajectory rose, yet the 30-year Treasury yield rose to around 5.10%—its highest level since November 2023. This juxtaposition is unusual: in many risk-off phases, longer yields tend to rally on safe-haven demand for government debt, or retreat if the market anticipates slower growth. The current dynamic suggests that while investors are seeking protection against fiscal risk, they are also assessing the attractiveness of the Treasury market at the higher end of the yield curve, possibly reflecting expectations that the debt expansion may tighten future budgetary constraints and influence the path of inflation and growth.

The fiscal trajectory also intersects with evolving expectations around monetary policy. In the wake of a trading environment shaped by a U.S.-China trade truce and renewed debate over the size and scope of deficit-financed stimulus, markets have begun to price in the possibility that the Federal Reserve may not need to tighten aggressively in the current year. The interplay between fiscal support and monetary normalization remains delicate: while tax cuts and spending could lift demand in the near term, the higher debt load could challenge long-run growth potential and complicate the fiscal outlook for interest rates and inflation. In such a context, investors and policymakers alike must weigh the immediate stimulative push against longer-term financial stability and the potential for broader market volatility if debt dynamics become more burdensome.

Looking ahead, the market will closely monitor the ongoing debate on the bill’s provisions and the possible implications for the debt trajectory. If the Senate engages in further debate and the bill undergoes revisions, the timing and size of fiscal stimulus could shift, influencing expectations for both yields and currency dynamics. The debt path will also interact with inflation expectations, as investors digest whether the proposed policies could prop up demand enough to lift price pressures or whether other factors—such as global supply chains, energy prices, and labor conditions—will play a more decisive role in inflation outcomes. In this environment, the dollar’s direction will likely continue to hinge on evolving fiscal policy signals, the perceived credibility of deficits, and how these factors intersect with the Federal Reserve’s reaction function.

The broader implications for U.S. debt management and market functioning are significant. A larger debt stock can influence the government’s borrowing costs, crowding out private investment and potentially altering the term structure of interest rates. If investors demand higher yields to compensate for increased debt, longer-dated notes may continue to move higher, which in turn can impact mortgage rates, corporate borrowing costs, and broader financial conditions. Conversely, if risk sentiment improves due to improvements in policy clarity or signs that deficits will be managed prudently, demand for U.S. Treasuries could stabilize, supporting the dollar and Treasury prices. In any scenario, the market will remain highly attuned to fiscal developments, credit ratings, and the evolving relationship between fiscal policy and monetary accommodation or tightening.

The fiscal debate also reverberates through currency markets as participants reassess competition for capital across regions. In the near term, the dollar’s softness may persist if investors conclude that the anticipated stimulus will support growth without triggering runaway inflation or additional monetary normalization. Yet the debt question remains a central risk, and a sharper debt trajectory could reintroduce headwinds for the dollar should investors demand greater compensation for risk. The coming days and weeks will be pivotal as lawmakers negotiate the final contours of the package and as market participants interpret what those contours mean for the United States’ medium- to long-term fiscal and economic outlook.

US PMIs, Fed Williams, and the Global Rate Outlook

As markets digest the evolving fiscal scenario, attention is turning to domestic economic indicators and central-bank guidance that could reshape rate expectations. The early May period has been marked by preliminary S&P Global PMIs for the United States, which are closely watched as barometers of economic momentum across manufacturing and services sectors. Investors are weighing the PMIs against the backdrop of the debt- and deficit-driven policy environment, with the data expected to influence the timing and magnitude of any potential shift in monetary policy. The PMIs carry implications for perceptions of growth momentum and inflation pressures, which in turn shape the trajectory of policy expectations among traders and policymakers.

An additional layer of complexity comes from commentary by Federal Reserve officials, notably President John Williams of the New York Fed, who has been a central figure in shaping the narrative around trimming or maintaining accommodative policy. Williams’ remarks and the incoming data are seen as potential catalysts that could influence the balance of bets on further rate reductions versus a hold or even a reconsideration of the rate-cut path. Market participants are weighing whether the Fed will adhere to the market’s pricing of two additional quarter-point rate cuts for this year, a stance that would align with earlier projections and with the broader expectations following the global trade truce and fiscal framework.

In parallel, the European data stream has added a global dimension to the rate outlook. The eurozone PMIs have already pointed to contraction, reinforcing concern about growth dynamics in the region. While the European Central Bank has signaled a readiness to support the economy with policy measures, investors still anticipate that the ECB will deliver additional rate cuts this year—a total of around 50 basis points, according to current expectations. The Bank of England and other major central banks have similarly faced divergent growth signals, adding to the sense that global monetary policy is entering a more nuanced phase where relative policy stances matter as much as absolute levels of stimulus.

UK PMI data appeared marginally better than forecast, providing a modest boost to expectations around domestic demand. The mixed global data landscape means that currency traders will be vigilant for any divergence in signals from the U.S. and Europe. If U.S. PMIs show resilience and the Fed signals a continued willingness to ease in measured steps, the dollar could maintain its soft tone relative to other major currencies. Conversely, if U.S. data deteriorates or if Fed officials adopt a more hawkish posture than anticipated, the dollar could regain ground as rate expectations shift.

From a market psychology standpoint, the narrative around the U.S. economic outlook remains a delicate balance. The prospect of significant fiscal stimulus coexists with the potential for higher long-term debt service costs and the possibility that the policy mix could keep inflation pressures contained or, conversely, feed them if demand outstrips supply. The path of rates in the coming months will depend on how the data evolves, how Congress proceeds with the fiscal bill, and how geopolitical developments—such as the global situation in the Middle East—interact with the domestic growth picture. Investors will be watching for any signs that inflation expectations become more anchored or more volatile, as these signals would have a direct bearing on the timing of further rate adjustments and the currency’s direction.

Additionally, the dollar’s trajectory has to be interpreted in light of cross-asset dynamics. A weaker dollar can support non-dollar assets by making them cheaper for international buyers and by lifting dollar-denominated commodities prices in local currencies. Yet, if the debt framework is perceived as unsustainable, currency depreciation could accelerate as investors demand higher risk premia. The confluence of PMIs, central-bank commentary, and geopolitical headlines will shape near-term volatility, and risk managers will be keen to adjust hedges and positioning as new information arrives.

Stocks, Safe Havens, and Commodities

Equity markets extended losses as the day unfolded, with major indices retreating as investors rotated into safe-haven assets amid the ongoing fiscal debate and growth uncertainty. The Dow Jones Industrial Average fell almost 2% on the session, signaling a broad risk-off tone that would usually bolster government bonds and precious metals. Yet the bond market painted a more nuanced picture: while equities sold off, precious metals found renewed demand, underscoring a flight to safety in a complex risk environment. The rally in gold highlighted its role as a traditional hedge during periods of fiscal ambiguity and geopolitical tension, while the euro and Swiss franc also benefited from risk-off flows as investors sought liquidity and diversification.

Oil prices moved lower as the market absorbed geopolitical headlines and reinforced expectations that supply could remain steady in the near term despite potential supply disruptions. The price action reflected a balance between demand-side considerations and the dynamics of risk premia. If talk of a renewed Israeli-Iranian confrontation abates or if diplomatic negotiations gain momentum, oil fundamentals could shift toward offering additional upside exposure due to supply constraints or sanctions risk. Conversely, if tensions intensify or if sanctions escalate and persist, the oil market could experience a renewed push higher as supply risks intensify and production adjustments are required to stabilize markets.

In the realm of alternative assets, bitcoin surged to new all-time highs, mirroring investor interest in non-dollar hedges amidst the broad move away from U.S. assets. The cryptocurrency’s strength during episodes described as “Sell America” environments underscores its perceived appeal as a decentralized store of value and a potential diversifier when traditional markets encounter heightened fiscal and geopolitical uncertainty. The broader trend of digital assets moving in tandem with gold during such risk-off episodes illustrates the evolving role of cryptocurrencies in the global investment landscape, where traders look for instruments that can resist currency depreciation and provide a hedge against unexpected policy shifts.

Meanwhile, the market’s attention on policy and macro risk continues to shape sector-specific dynamics. The energy sector, for instance, has to contend with evolving expectations around sanctions, supply risks, and demand growth. In a world where geopolitical tensions can alter trade flows and price signals quickly, energy equities and commodities react decisively to new headlines, while more cyclical sectors may experience volatility in line with overall risk sentiment. For investors, this environment calls for a nuanced approach to diversification, risk management, and exposure across equities, fixed income, and alternative assets.

Geopolitical developments continue to color market expectations, with the possibility of fresh nuclear talks between Iran and the United States providing a counterweight to some of the risk-off pressures. Such developments can have a tangible effect on market sentiment, influencing price action across equities, currencies, and commodities. While the headline risk remains elevated, the market’s ability to absorb and interpret geopolitical news through the lens of macro fundamentals—growth, inflation, policy paths—will be pivotal in determining how asset classes reprice in the days ahead.

The broader narrative also includes a renewed recognition of how investors seek hedges against policy risk and currency risk. As the dollar weakens, non-dollar assets appear comparatively more attractive for international buyers, potentially supporting commodities, equities in non-dollar currencies, and alternative stores of value. Conversely, if fiscal stimulus is perceived as a pathway to stronger growth with stable inflation, the dollar might recover as the Fed signals a path toward normalization and as global growth broadened in other regions, prompting shifts in capital allocation. The market’s next move will likely hinge on the balance of policy clarity, data momentum, and geopolitical developments—factors that together shape risk appetite, asset correlations, and liquidity conditions.

Market Sentiment, Geopolitics, and the Path Forward

As traders parse the implications of the House committee’s approval of the fiscal bill and await Senate deliberations, market sentiment remains sensitive to both domestic policy and international tensions. The possibility that the proposed plan could deliver long-term growth benefits while simultaneously expanding the debt burden creates a bifurcated narrative: near-term stimulus versus longer-term fiscal sustainability. This duality is reflected in currency and fixed-income markets, where expectations for growth-supportive policy exist alongside concerns about debt service costs and the capacity of policymakers to manage a heavier fiscal load.

From a geopolitical perspective, the Israel-Iran dynamic adds another layer of risk to market outlooks. Investor attention is increasingly tuned to headlines about conflict risks and diplomatic efforts, as these events can disrupt energy supply chains and alter risk premia across commodities, currencies, and equities. In this environment, gold’s appeal as a hedge remains prominent, while bitcoin’s ascent suggests a broader shift toward alternative assets that may offer a store of value independent of traditional financial systems. The interplay between such geopolitical developments and macroeconomic policy will likely drive volatility and trading opportunities in the near term.

Regulatory and policy considerations also loom large. As markets price in a possible shift in the trajectory of U.S. monetary policy, central banks worldwide may recalibrate their own policy approaches in light of evolving inflation dynamics, growth signals, and financial stability concerns. The ECB’s approach to rate cuts and the BoJ, BoE, and other major central banks’ responses will be crucial in forming a synchronized but nuanced global policy stance. Traders will need to keep a close watch on communications from central-bank leadership, as these signals can catalyze rapid reallocation across asset classes.

Looking ahead, investors should consider incorporating a framework for assessing the balance of risk and reward across macroeconomic, fiscal, and geopolitical dimensions. A disciplined approach to portfolio construction—emphasizing diversification, hedging, and a careful evaluation of currency exposure—will be essential as policymakers navigate the intersecting paths of stimulus, debt sustainability, and global growth. The coming weeks are likely to bring additional data releases, policy updates, and geopolitical news that will shape the path of the dollar, interest rates, and global asset prices.

Market Outlook: Implications for Investors and Policy

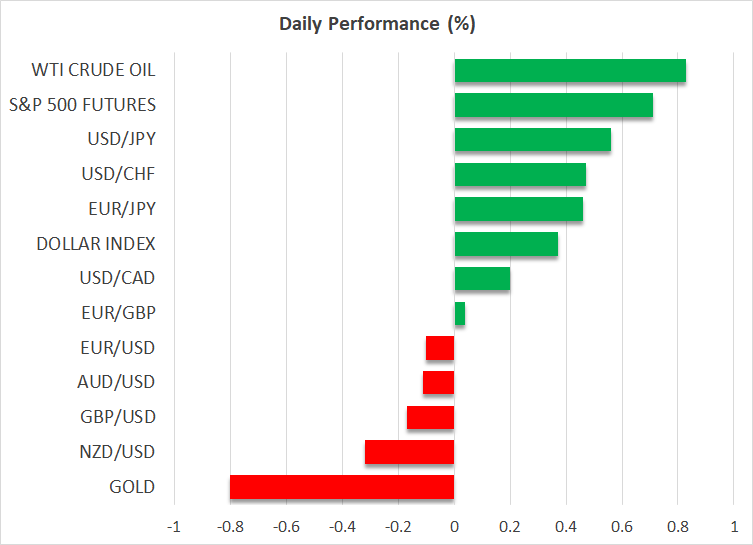

In summary, the market environment today reflects a tension between the potential for near-term growth supported by fiscal stimulus and the longer-term implications of a higher debt burden. The dollar’s softer tone, the rise in long-term yields, the retreat in equities, the resilience and rally in gold, and the strength of non-dollar assets like bitcoin all illustrate a complex, multi-asset response to evolving policy signals and geopolitical risk. As the House advances the fiscal plan toward a broader vote, investors will be closely watching how the Senate negotiates the bill and whether it will sustain or alter the projected debt path. The way these fiscal choices unfold will likely shape the currency landscape, the pricing of risk, and the posture of central banks around the world.

Conclusion

The day’s market activity underscored the intricate balance between fiscal ambition and debt sustainability, with investors parsing a bill that could reshape the U.S. fiscal framework for years to come. The dollar’s retreat alongside rising long-term yields highlighted a nuanced reaction to the debt discussion, where concerns about deficits coexist with expectations of continued growth and policy stability in the near term. Across assets, traders sought protection in gold and other safe-haven instruments, while bitcoin embodied a growing appetite for non-traditional hedges in a world rich with policy ambiguity and geopolitical risk. As the administration, Congress, and the Federal Reserve navigate these intertwined forces, the coming sessions will be crucial in determining the trajectory of the dollar, interest rates, and broad market risk sentiment. The dynamic interplay between fiscal policy, monetary policy, and geopolitical developments will continue to shape asset prices, investor behavior, and the global yield and currency landscape in the weeks ahead.