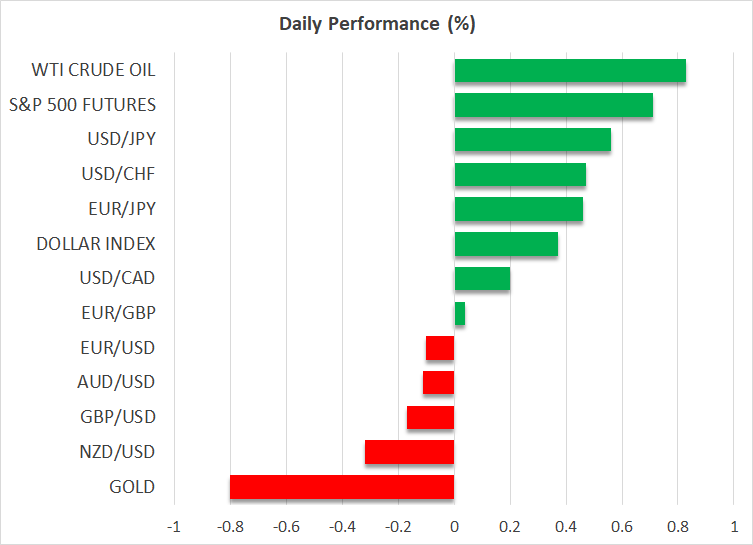

A midday surge in risk appetite across key asset classes followed a surprise signal from Washington that tariffs could move toward a negotiated settlement with Canada and Mexico, easing an immediate tariff-driven selloff and sparking a broad-based re-risk rally. U.S. 10-year Treasuries showed signs of topping after a sharp intraday reversal, while the euro vaulted above a pivotal level, the yen staged a technical rebound, and U.S. stock index futures extended a cautious bounce. The market is navigating a delicate balance between policy uncertainty, growth headlines, and the possibility that tariff tensions might loosen in the near term, even as data releases later this week loom large for the path of policy and risk. This backdrop sets up a complex, data-driven landscape for traders across currencies, bonds, and equities as they balance technical signals with macro fundamentals.

Tariff news and risk sentiment shift

The catalyst for the latest risk on rally stemmed from a combination of tariff headlines and a high-profile media appearance by a key U.S. official. In the hours after Washington announced fresh 25% tariffs on certain Canadian and Mexican imports, a veteran market commentator suggested there could be room for a compromise. The remarks implied that Trump may be willing to meet Canada and Mexico halfway, a framing that markets interpreted as a potential de-escalation of tariff tensions rather than an escalation. This interpretation, contingent on no sudden reversals or contradictory statements from Washington, helped investors recalibrate risk expectations.

Equity futures extended a bid as bond markets adjusted to a more favorable risk environment. The immediate reaction featured buyers returning to risk assets, with broad-based strength in stock index futures and a decline in some defensive plays. Concurrently, the sentiment shift was accompanied by a currency move: the euro strengthened as dollar weakness broadened, and the dollar index traded softer against a basket of major peers. The initial dynamics suggested a classic risk-on response: when tariff fears recede, risk appetite tends to improve, supported by constructive macro data and technical setups that favor a continued bid in equities and a cautious pullback in perceived safe-haven assets.

From a macro perspective, the narrative hinges on the persistence of softer data signals that had previously weighed on risk assets, and the potential for tariffs to be used as a bargaining chip rather than as a policy certainty. The softer data backdrop, if sustained, could keep rates at the lower end of expectations, which in turn supports higher equity valuations and a more permissive environment for carry trades and commodity-linked bets. However, the market’s optimism remains conditional on follow-through: a hard, durable commitment to a deal with Canada and Mexico, or a credible signal of a broader trade thaw, would be required to sustain a longer cycle of risk-on sentiment. In the near term, traders are watching for any additional commentary that could either reinforce a tentative thaw or reintroduce the risk of a rapid tariff unwind.

In the backdrop, upcoming U.S. data releases loom as crucial calibrators. The ISM Services PMI and the ADP employment report, followed two days later by the nonfarm payrolls data, will likely test the durability of the current mood. If the data weaken further, even a tariff détente might not be enough to fully offset concerns about domestic demand and growth momentum. Conversely, a stronger-than-expected print could amplify risk-on sentiment and extend the rally across risk assets. The market narrative thus centers on the delicate interplay between policy signals, tariff expectations, and the evolving data landscape, with the potential for a short-term relief rally to give way to a more sustained re-pricing if the fundamental data confirm or refute the tariff thaw scenario.

U.S. Treasuries: signals of a near-term top for bond prices

The U.S. 10-year Treasury futures, which had been a crowded trade favoring a continued rise in price (i.e., a decline in yields) for an extended stretch, showed a notable turning point in the most recent session. A bearish engulfing candle on the daily chart—where a down-day fully engulfs the prior up-day—signal that the near-term momentum may be shifting. This pattern is commonly interpreted as a potential top for the current rally in bond prices, implying a possible uptick in yields from recent lows and a rebalancing of relative value between bonds and other asset classes.

The price action around the December 2024 swing highs proved crucial. The failure to break above that key resistance area was followed by a pronounced reversal, reinforcing the view that the immediate bull run in Treasuries could be peaking. This set up a risk scenario in which the bulls who had been betting on lower yields might need to reassess their positions in the near term. The technical setup included a close beneath the 200-day moving average, a classic signal that momentum may be shifting toward a weaker breadth for the long end of the curve. Together with RSI (14) breaking its uptrend, these indicators point toward increasing risk that the bullish trend in yields—driven by a combination of growth concerns and policy expectations—may have run its course for the moment.

Market participants should watch for the confluence of a few other indicators as a confirmatory signal. If yields begin to push higher and the 10-year note cannot reclaim key support around the earlier swing levels, the case for a more sustainable uptick in yields would strengthen. Conversely, a rapid rebound in prices with a return to the 200-DMA could re-assert the bullish bias on the Treasuries side, suggesting the recent bearish signal was a temporary pullback within a longer-term uptrend in bonds. In practice, traders may reweight portfolios to balance the interplay between yield trajectory, inflation expectations, and the evolving tariff backdrop. The immediate implication is a potential re-pricing of risk assets that had benefited from lower yields, with higher yields potentially capping further equity gains and pressuring duration-sensitive strategies.

EUR/USD: a powerful bullish breakout evident

The euro’s performance over the past sessions underscored a decisive shift in relative currency strength. EUR/USD not only tested but decisively cleared the 1.0600 barrier, a level that had acted as a critical boundary for the pair for several sessions. The breakout was driven by a combination of dollar weakness, supportive European dynamics, and technical factors that amplified buying pressure. Increasing European military spend and other macro factors contributed to the euro’s bid, helping it absorb and then overcome selling pressure that had previously capped gains in the pair.

Beyond the initial breakout, the euro chart now points toward the next layer of resistance around 1.0668, with the next milestone potentially being the 200-day moving average. The price action around the breakout suggests momentum staying with the bulls for the near term, supported by technically favorable indicators such as RSI (14) and MACD, both pointing toward buying the dips rather than selling rip moves. In practice, the breakout through 1.0600 changes the immediate narrative for EUR/USD, turning what had been a potential consolidation into a more durable uptrend trajectory, at least in the near term. Traders may increasingly look for pullbacks to 1.0600-1.0530 as potential entry points for longer-term longs, given the clear technical breakdown of the prior range.

From a risk perspective, the durability of the breakout will depend on ongoing macro data and policy signals. If euro-area fundamentals remain on solid footing and U.S. data supports less favorable domestic growth, the euro could extend gains. On the other hand, a soft U.S. print or negative tariff news could reverse the dynamic, pulling the pair back toward 1.0530 or lower. The current setup, however, highlights a shift in market leadership toward the euro in the near term as a counterpoint to dollar softness. Market participants should monitor price action near the 1.0600 level for possible support on pullbacks and for any signs of a break below to gauge the sustainability of the breakout.

USD/JPY: bulls reclaim ground with a technical tilt

The USD/JPY pair has been a focal point for traders due to the interplay between U.S. risk sentiment and Japanese monetary policy considerations. In yesterday’s session, the pair showed resilience after an earlier dip, rebounding to deliver a constructive setup for a continued recovery. A bullish pin candle at the close suggested a potential extension of the rebound toward the major resistance aligned near 151, a level that has historically acted as a ceiling for several attempts at a sustained breakout. The 148.65 swing low remains an important downside anchor, acting as a psychological and technical boundary for the downside.

Momentum indicators suggest a moderately bullish tilt, reinforcing the idea that buyers may be inclined to test higher levels if pullbacks occur. The combination of risk-on sentiment and a recovering yen carry trade unwind has supported a more constructive stance for USD/JPY in the near term. However, the challenge remains to breach and sustain moves above the 151 level, given that a successful test could open the door to retesting the next resistance stack and potentially prolong the upside.

For traders, the near-term takeaway is to consider scenarios where USD/JPY could advance toward 151 with intermittent retracements. If the price sustains above the current resistance and consolidates near the 151 mark, the next targets might include the 152 area or a return to prior highs, contingent on broader risk sentiment and U.S. data momentum. Conversely, a renewed wave of risk aversion or stronger yen demand could cap the rally, with the 148.65 level continuing to serve as a critical check on the downside. The current narrative supports a measured approach to the pair, with a bias toward upside in the absence of renewed risk-off catalysts.

S&P 500 futures: a make-or-break moment around the 200-DMA

Equity indices, particularly U.S. stock index futures, have been navigating a precarious balance between technical support and momentum shifts. S&P 500 futures faced a conspicuous test of long-standing uptrend support before staging a late-session rebound, yet the price action remains technically fragile in the absence of Lutnick’s commentary. The market closed below the 200-day moving average, a level often considered a bellwether for longer-term direction. The move also included a break below a critical horizontal support around 5808, which had served as a key anchor since October of the prior year. The RSI (14) and MACD indicators were trending lower, supporting a bearish bias on momentum metrics and suggesting that the near-term pullback may persist.

Despite the immediate weakness, the bounce off the 200-DMA has created a potential window for bulls seeking a short-covering squeeze after a period of declines. The technical landscape highlights notable resistance in the vicinity of 5875 and the round-number 6000, with several intraday probes failing to break higher in the recent sessions. The 50-day moving average also sits as a potential hurdle for any sustained upside, and traders are watching for a breakout above these levels as a sign of renewed risk appetite. A break and close below the 200-DMA would be a clearly bearish signal, likely opening the door to tests of the 5724 level and even a price gap down toward 5670 in a more disruptive scenario.

From a strategic standpoint, market participants must weigh the potential for a near-term bounce against the risk of renewed selling pressure if the 200-DMA fails to hold. The price action underscores the importance of the 200-DMA as a barometer for the bullish vs. bearish dynamic in the equity complex. Should the market reclaim the 200-DMA and push through 5808 on a sustained basis, the environment could shift toward a more constructive setup. Conversely, a sustained close below this pivotal moving average could shift the risk balance toward a deeper corrective phase, particularly if negative macro surprises or renewed tariff fears reemerge.

Policy catalysts and market outlook: the interplay of tariffs, data, and risk appetite

The narrative surrounding tariffs continues to shape market expectations in the near term. While the Lutnick remarks introduced a temporary reprieve that supported a risk-on tilt, the policy backdrop remains unsettled, with tariffs framed as a bargaining tool rather than a settled policy stance. Traders are right to view this as a negotiating tactic that could influence market dynamics for days to weeks, depending on how events unfold and which party remains flexible in negotiations. The key takeaway is that tariff uncertainty is not yet resolved; it is being actively negotiated, with the potential to swing market sentiment back toward risk-off if negotiations stall or if any party signs a more aggressive posture.

This evolving policy environment intersects with an important data calendar. The upcoming ISM Services PMI and ADP employment numbers, followed by the crucial nonfarm payrolls release, will be central to validating or challenging the risk-on rally. If the data confirm stronger activity and job creation, the case for a resilient economy could bolster risk-on bets and support higher equities, while easing pressure on bond yields as investors seek growth resilience. If the data disappoint, the rebound may prove fragile, with yields and the dollar reasserting themselves and EUR/USD potentially retracing gains.

In evaluating market positioning, traders should consider the potential for rapid shifts in risk sentiment driven by policy developments and data surprises. The balance between a possible tariff thaw and softer domestic data creates a nuanced environment where short-term opportunities exist across currencies, fixed income, and equities, but with elevated risk of sharp reversals if either side of the policy and data equation moves unfavorably. The best approach is to maintain a diversified, data-driven posture with a readiness to pivot on new information, while staying attuned to the technical structures that continue to guide price action.

Technicals and risk management: translating signals into strategies

Across asset classes, traders are weighing the implications of the current technical readings. The bearish engulfing pattern seen in U.S. Treasuries translates into a cautious stance on longer-duration bets and opens room for a potential shift in the yield curve. In the foreign exchange space, EUR/USD’s breakout above 1.0600 signals a renewed trend with a likely target near the 1.0668 level, followed by a test of the 200-DMA if upside momentum persists. For USD/JPY, the bullish pin candle hints at a continuation toward the 151 resistance, though the 148.65 swing low remains an important anchor that supporters of a bullish view will watch for as a potential stop-loss anchor in case of a re-emergent risk-off pulse.

In equities, the S&P 500 futures scenario remains delicate. A break below the 200-DMA would enhance bearish negative momentum, inviting tests of key downside levels like 5724 and a potential gap toward 5670. However, if bulls can push through resistance around 5875 and then challenge 6000, a more constructive trajectory could emerge, potentially supported by an improving risk sentiment and favorable macro data. Traders should also monitor the 5808 support level as a reference point for risk management decisions and consider the implications of a sustained move above the 200-DMA for timing risk-on entries.

From a practical standpoint, the trading approach that aligns with these dynamics emphasizes disciplined risk controls, clear stop-loss placement, and explicit scenarios for both upside breakouts and downside risk. Position sizing should reflect the elevated probability of swift policy-driven shifts, and adherence to a predefined plan for reacting to unexpected headlines will help protect capital in a volatile environment. The evolving policy and data landscape suggests that strategy should be flexible, data-responsive, and anchored by robust technical analysis to identify reliable entry and exit points.

Data calendar and near-term triggers

The week ahead features a lineup of U.S. macro releases that are likely to be decisive in shaping near-term momentum. The ISM Services PMI will offer a read on services-sector health, a critical engine of overall economic activity, while ADP employment data will give an early glimpse into the labor market’s direction ahead of the official payrolls report. Both data points are instrumental in gauging domestic demand and the resilience of growth in the face of tariff dynamics and global uncertainty. The nonfarm payrolls data, due closer to month-end, will be the ultimate decider for the pace of monetary policy expectations and risk appetite.

Investors should also be mindful of external developments that could influence the price action in coming sessions. Trade headlines, central bank communications from major economies, and geopolitical developments can all act as catalysts that either reinforce the current tilt toward risk-on or trigger renewed risk-off moves. In such an environment, traders may find more consistent opportunities by focusing on high-probability setups around the most liquid levels and by using a disciplined approach to risk management. The interplay of data, policy signals, and macro headlines will continue to shape momentum across currencies, bonds, and equities in the days ahead.

Market interpretation and strategy for traders

In aggregate, the market narrative suggests a cautious optimism that tariff tensions may ease, accompanied by a mixed bag of technical signals across asset classes. The euro’s breakout provides a clear near-term upside bias in the currency space, while the U.S. dollar softening supports a risk-on stance that has lifted both equities and other risk-sensitive assets. However, the technicals in U.S. Treasuries warn that a sustained rally in bond prices may be challenged in the near term, and the S&P 500 futures face a critical test around the 200-DMA. Traders should be prepared for a range-bound environment in the near term, punctuated by episodic bursts of direction driven by tariff news and macro data.

A practical strategy would emphasize diversified exposure across asset classes, with a bias toward spots where the risk-reward seems favorable under the current macro and technical setup. In currencies, look for pullbacks toward key levels in EUR/USD as potential buying opportunities on a confirmation of risk-on sentiment. In equities, monitor the 200-DMA closely and be ready to take profits or reduce exposure if price closes decisively below that level. In Treasuries, maintain a tactical stance with attention to yield signals and consider hedging against a potential rise in yields if the bearish engulfing pattern extends or if selling pressure intensifies.

Ultimately, the near-term path for markets remains highly data-dependent and sensitive to policy communications. The partial tariff thaw narrative provides a plausible foundation for a risk-on phase, but investors should stay vigilant for counterpoints from either policy hardliners or less favorable data prints. The balance of probabilities at this juncture favors a continuation of fluctuating but gradually improving risk sentiment, contingent on the interaction between tariff dynamics, macro data releases, and the ongoing assessment of global growth prospects.

Conclusion

The recent market mood reflects a nuanced blend of policy speculation, technical signals, and macro developments. Tariff fears appear to have eased modestly on the back of Lutnick’s remarks about a possible compromise with Canada and Mexico, triggering a risk-on rally across equities and a broad-based retreat in safe-haven assets. In parallel, the U.S. 10-year Treasury futures have shown a bearish engulfing pattern that raises the possibility of a near-term top in bond prices and a potential rise in yields. EUR/USD breached the 1.0600 threshold to the upside, pointing to continued euro strength in the near term, while USD/JPY carved out a bullish path toward 151, contingent on market risk appetite. S&P 500 futures managed a bounce but remain vulnerable to a close below the 200-DMA, which would herald deeper downside. The evolving tariff narrative, together with critical data prints on ISM services, ADP, and nonfarm payrolls, will likely dictate the immediate trajectory for risk assets in the coming sessions. Traders should navigate with a disciplined, data-driven approach, employing robust risk controls, and staying attuned to shifting policy signals and market momentum.