VantagePoint Trading Software presents itself as a forecasting platform that fuses end-of-day market data with artificial intelligence to project near-term price movements. Its core proposition is to deliver market forecasts for 1 to 3 days ahead, equipping traders with timely insights intended to improve trade timing and maximize profit potential. The AI-driven forecasts extend across a broad spectrum of asset classes, including stocks, futures, foreign exchange (Forex), exchange-traded funds (ETFs), and cryptocurrencies. In the current focus on American Airlines and its NASDAQ ticker AAL, this journal-style analysis explores how the software’s predictive signals align with recent price action and what that implies for traders considering AAL stock and related strategies.

VantagePoint: AI-Driven Forecasting for Near-Term Markets

VantagePoint is built around the premise that combining traditional end-of-day data with advanced predictive artificial intelligence can yield forward-looking insights about market direction. The platform emphasizes short-horizon forecasting, specifically targeting moves that are likely to unfold within a 1 to 3 day window. For traders, this short horizon is designed to improve timing for entries and exits, thereby enhancing potential profit opportunities across diverse markets. The tool’s scope includes equities, futures, Forex, ETFs, and cryptocurrencies, acknowledging the breadth of instruments that modern traders monitor and trade on a daily basis.

The technology at the heart of VantagePoint leverages neural networks and other AI methodologies to forecast market direction and strength. By applying deep learning techniques to historical price data and derived indicators, the platform aims to predict what the market is going to do next, rather than just recount what has already happened. This approach is anchored in the belief that patterns captured by neural networks can reveal recurring dynamics in price movements that traditional methods may overlook. As a result, traders can gain a sense of impending momentum shifts and directional clues in advance of the actual price action.

Within the platform, users encounter a suite of predictive indicators designed to quantify momentum and potential turn points. Among these indicators, a blue predictive indicator line is often highlighted for its crossovers with other reference measurements, such as a black simple moving average. When the blue line crosses above the moving average, it is interpreted as a bullish signal suggesting the potential for upward price movement. On the other hand, a cross in the opposite direction may indicate bearish conditions. The predictive indicators are complemented by the platform’s proprietary neural index indicator, which evaluates strength and weakness over specified time horizons—commonly a 48-hour window in the context of short-term forecasting. A shift in the neural index from red to green is presented as an emblem of strengthening momentum and a potential bullish tilt.

Additionally, the platform provides forecasted high and low levels that lie above or below yesterday’s actual high and low, offering traders a sense of the predicted trading range. The combination of these indicators—bullish crossovers, neural index transitions, and forecasted high/low levels—forms the basis for actionable trading hypotheses rather than mechanical buy or sell signals. Traders are encouraged to consider how these integrated indicators align with their own risk tolerances, time horizons, and market views when planning entries and exits.

Beyond the raw signals, the AI-driven framework emphasizes the practical workflow of trading, including how to interpret and apply the forecasts in real markets. The objective is to empower traders to anticipate possible price trajectories with greater confidence, thereby enabling more informed decision-making in the context of volatile or swiftly moving markets. The overarching claim is that the AI-based predictive framework can reveal market direction and strength one to three days in advance, with the intent of delivering a navigational edge for informed trading decisions.

Market Context: The S&P 500 Bull Market and Bearish Warnings

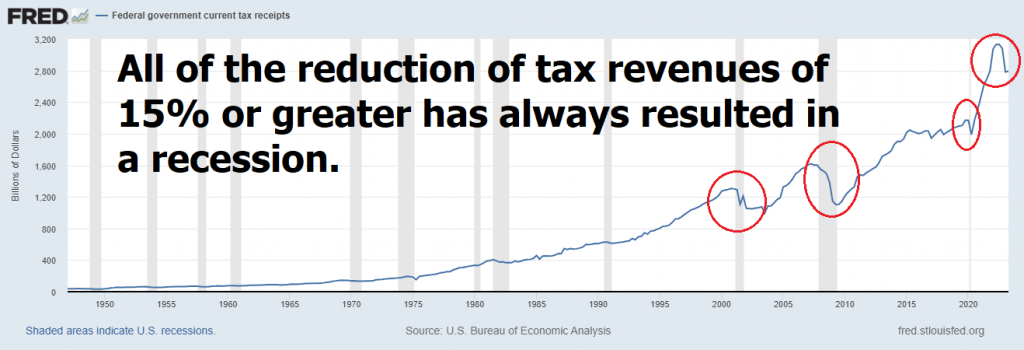

In the broader market backdrop, the S&P 500 has repeatedly drawn attention for its extended run as a bull market, approaching a historically long duration. The index is described as nearing a record for the longest U.S. bull market in history, with the duration measured in this assessment at approximately 3,500 days. Over this expansive period, the S&P 500’s ascent has exceeded 320% from its March 9, 2009 lows, a trajectory that is notable for traders and investors observing long-term market resilience after a deep collapse during the financial crisis. This historical context underscores how far equities have advanced over more than a decade and a half, and it frames the environment in which AI-driven forecasts and tactical trading ideas operate.

Even amid such a lengthy uptrend, the market narrative is not without controversy. There remains no shortage of bearish warnings and cautious sentiment among analysts who debate the future path of equities. Market participants, others in financial research, and a range of observers continue to discuss potential risks, drawdowns, or shifts in momentum that could alter the course of stocks and broader indices. Yet against this cautious backdrop, a substantial cohort of investors retains a constructive view, seeing continued upside potential in equities or at least a persistent capacity for gains under certain conditions. The tension between caution and optimism shapes how traders approach forecasts, signals, and trading strategies amid evolving macro and micro indicators.

While the bull market narrative remains dominant in many discussions, readers should recognize that forecasting markets involves balancing probabilities and acknowledging uncertainties. Traders often weigh historical performance, current momentum indicators, macroeconomic data releases, and sector-specific dynamics as they form judgments about what may come next. In this context, the VantagePoint platform’s AI-driven forecasts are used as a complement to fundamental and technical analysis, providing a short-horizon directional view that some market participants find valuable when planning trades or considering hedges. The emphasis for traders is not simply to predict movement in isolation but to integrate predictive signals with risk management, capital allocation, and a disciplined trading plan that accounts for potential drawdowns and changing market conditions.

Within this market framework, the case of American Airlines (AAL) takes on particular relevance. As a member of the airline sector, AAL’s price action and volatility can reflect both company-specific catalysts and broader momentum in travel, consumer demand, and related macro trends. The VantagePoint forecast signals for AAL have been examined to determine whether the platform’s predictive indicators align with recent price action and what implications this alignment might have for trading options, stock purchases, or related strategies. The combination of a long-running bull market backdrop with evolving risk signals creates a dynamic environment in which AI-driven forecasts and conventional trading considerations intersect, inviting traders to scrutinize both the macro context and micro signals in their decision-making.

American Airlines Focus: Signals, Momentum, and Forecast

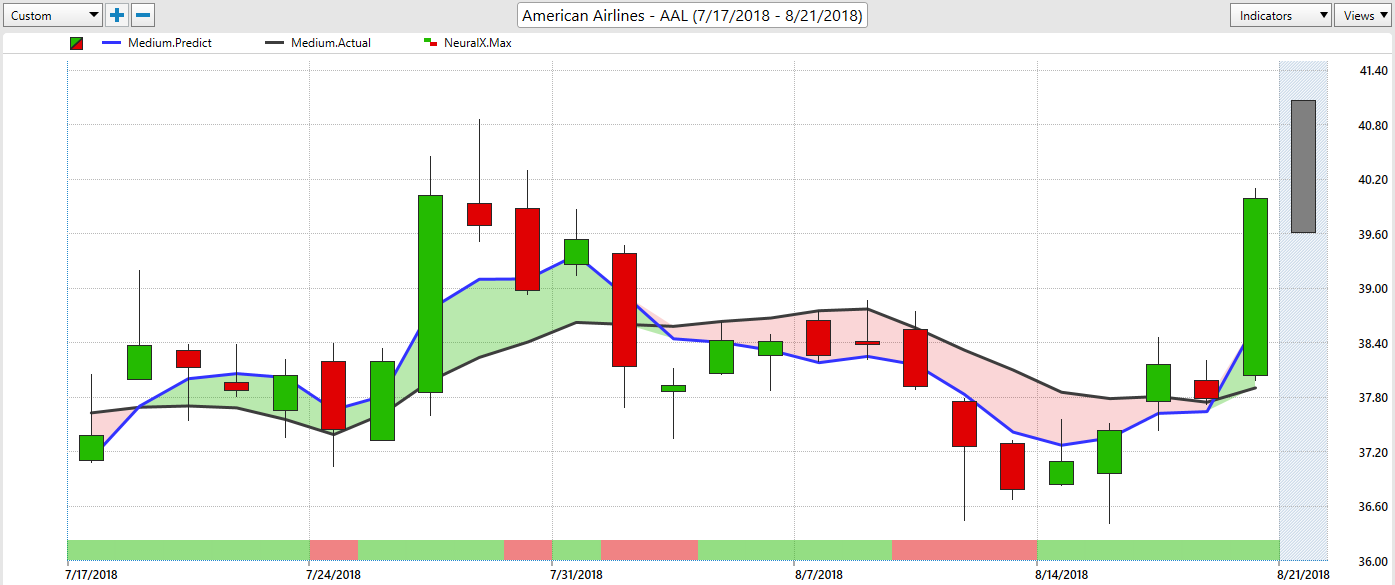

Taking a close look at American Airlines (AAL) through the lens of VantagePoint reveals a series of predictive indicators that traders may interpret as a potential setup for upside momentum. The platform’s analysis indicates upside momentum for AAL, which emerges from a confluence of technical signals and AI-derived projections. Specifically, a bullish crossover has been identified, characterized by the blue predictive indicator line crossing above the black simple moving average. This crossover occurred on August 17th in the evaluated period, signaling a potential shift toward bullish price action for AAL. The significance of this crossover lies in the alignment with other predictive signals that the platform monitors, creating a composite indication that momentum could continue to strengthen in the near term.

In addition to the blue predictive line’s crossover, the platform’s internal neural index indicator—an assessment of momentum strength within a 48-hour window—moved from RED to GREEN two days prior to the crossover. The transition from RED to GREEN is interpreted as a strengthening condition, reinforcing the narrative of a potential bullish environment for AAL over a short horizon. This dual signal—the crossover and the neural index transition—collectively contributes to a more robust case for the potential continuation of upward price movement, as one indicator supports or amplifies the other within the same forecasting framework.

Another important aspect of the forecast is the projection that the predicted high and low levels are above yesterday’s actual high and low. This implies a degree of upward momentum, suggesting that the price range anticipated by the model may extend higher than the prior day’s activity. The presence of such a forecast can bolster the interpretation of continued strength and serve as a data-driven rationale for traders to consider long exposure or to rely on higher-probability bullish scenarios in the near term. Taken together, these signals provide a cohesive narrative in which the AI-driven forecast aligns with observed price action and momentum indicators, presenting a case for ongoing bullish potential for AAL in the near horizon.

From a trader’s standpoint, the combination of signals supports the idea of a continued bullish indication for VantagePoint users who monitor AAL. The synthesis of a bullish crossover, a green neural index, and elevated forecasted highs relative to the previous day creates a framework within which traders may form a bullish bias or validate long-entry ideas. While these signals do not guarantee future outcomes, they offer a structured basis for considering strategies that exploit anticipated upside moves, taking into account appropriate risk controls and position management.

Key signals summarized

-

Upside momentum indicated by VantagePoint’s AI-driven forecast for AAL.

-

A bullish crossover: blue predictive indicator line crossing above the black simple moving average on August 17, signaling potential price acceleration.

-

Neural index transition: a move from RED to GREEN two days before the crossover, signaling increasing strength over a 48-hour horizon.

-

Forecasted high and low positioned above yesterday’s actual high and low, indicating expected continued strength in the near term.

-

The overall combination of indicators is interpreted as a supportive backdrop for continued bullish sentiment around AAL, prompting traders to consider strategic entry points and risk-managed exits.

Strategy Discussion: Stock Purchases, Stops, and Options

With these signals in hand, one strategy discussed for AAL centers on a straightforward stock purchase in the approximate price vicinity of $40. The rationale for this approach rests on the expectation of an upside move guided by the platform’s bullish signals. Entering a long position near the $40 level aligns with the predicted momentum and the higher-probability scenario suggested by the forecast. As a prudent risk-management practice, traders often place a sell-stop order to limit potential downside, and in this context a stop around $37.75 could be considered to mitigate possible losses if the market moves against the position. The use of a stop helps manage risk while allowing the potential upside suggested by the AI-driven indicators to unfold.

For active traders with a shorter investment horizon, alternatives involving options can be examined to capture amplified returns while controlling cost. Given the described market conditions and forecast signals, pursuing a premium debit approach may present a viable path to success. In particular, a debit call spread offers a structured way to participate in upside exposure while limiting total risk to the premium paid. The target strike for this strategy is estimated at roughly $43.50, derived from current price levels, expiry considerations, and the implied volatility associated with the chosen expiration.

A specific example involves the AAL September 21st regular monthly expiration, focusing on a 42/43.5 call spread. The proposed action would be to buy the 42 call and sell the 43.5 call for a net premium of approximately $0.33. This construction yields a defined risk profile: the maximum possible loss is limited to the premium paid, $0.33 per spread, while the maximum possible gain equals the difference between the strike widths (in this case, 1.50) minus the premium paid, totaling about $1.17 per spread. The resulting maximum reward-to-risk ratio, when calculated against the maximum loss, suggests a favorable odds scenario of approximately 3.55 to 1, assuming the price advances as anticipated by the AI forecast.

In evaluating whether this reward/risk balance is appropriate, traders should reflect on their own risk tolerance, capital allocation, and overall portfolio approach. Assessing the potential upside relative to the premium outlay and the time horizon until expiration is essential for informed decision-making. The analysis highlights a structured framework in which a debit call spread can translate predicted near-term strength into a defined risk-reward proposition, aligning the strategy with the momentum signals observed in the VantagePoint forecast for AAL.

Practical notes on implementation

-

The stock-based approach targets a near-term upside aligned with a bullish forecast, supported by the blue crossover signal and the green neural index.

-

The optional spread strategy provides a way to monetize upside while capping downside risk to the premium paid.

-

When selecting expiry dates, traders consider the 1–3 day forecast horizon emphasized by the platform, while recognizing that implied volatility and time decay impact option pricing.

-

Position management is essential: monitoring for shifts in momentum, updating risk controls, and adjusting stop levels as new data arrive can help maintain alignment with the forecasted scenario.

-

Traders may choose to blend approaches, initiating a small stock position to participate in the upside while also constructing an options position to attempt to maximize return if the forecast proves accurate.

Practical Application: Interpreting AI Signals and Trading Discipline

To maximize the value of VantagePoint’s insight, traders should integrate AI-generated forecasts with disciplined trading practices. The integration involves translating the platform’s qualitative signals into concrete trading actions that respect risk limits and account for individual goals. The AI-driven forecasts indicate directional momentum and potential price targets, but they should be reconciled with a trader’s overall market view, time preferences, and risk tolerance. Understanding how the blue predictive line’s cross above the moving average translates into entry timing, while also recognizing the neural index’s momentum quality, can help traders decide when to execute trades and how to structure exits.

As traders consider whether to pursue stock purchases or option-based strategies, the decision-making process should encapsulate several core components: timing (horizon of 1–3 days), risk management (stops and position sizing), and reward expectations (measured against the premium or cost of the strategy). The concept of a bullish signal must be weighed against potential market volatility and macroeconomic uncertainty. In this context, the VantagePoint AI can be viewed as a directional compass rather than a precise forecast, guiding traders toward higher-probability setups while leaving room for adaptation as new data emerge.

The platform’s value proposition centers on deploying deep learning techniques to reveal prospective market moves before they unfold. By providing a probabilistic outlook on direction and strength, the software aims to empower traders to act with better timing. The practical takeaway for users is to leverage the AI’s 1–3 day forecasts in combination with robust risk controls, ensuring that each trading decision aligns with the user’s strategy, whether pursuing stock gains or leveraging the leverage of options.

Signals to watch in practice

-

AAL’s price action in relation to the $40 entry zone and the strength of the bullish forecast.

-

The persistence of upside momentum as indicated by sustained green status in the neural index over subsequent days.

-

The relation between predicted highs/lows and actual price movements, noting whether the forecast continues to imply strength.

-

The effectiveness of a stop strategy (e.g., around $37.75) in containing losses while allowing for upside capture.

-

The viability of an options spread given the time to expiration, implied volatility, and realized price movements driven by the underlying AI signal.

-

The alignment of multiple predictive indicators to create a cohesive picture of near-term market direction for AAL.

Adoption, Demonstrations, and Trader Confidence

VantagePoint’s AI-based forecast capabilities are presented as a tool for traders seeking to enhance their decision-making process. The platform emphasizes the advantages of AI-driven predictions in the 1–3 day horizon, highlighting the potential for up to 87.4% accuracy in some forecasts when applying neural network analysis to market data. This level of precision claims to be a function of deep learning processes that enable the system to anticipate market direction and strength ahead of actual price changes. The emphasis is on showing traders what the market is going to do next, rather than solely recounting what has already transpired.

For those curious about the platform’s practical value, the company invites prospective users to request a personalized demonstration of VantagePoint Software. The demonstration is framed as an opportunity to understand how the software can be applied to individual trading styles and portfolios. The narrative also highlights the confidence of a substantial user base, noting that more than 25,000 traders trust the software to aid their trading efforts. This adoption level is presented as evidence of the platform’s relevance and usefulness to a broad audience of market participants who seek to improve their outcomes through AI-assisted analysis.

The combination of technical indicators, predictive AI capabilities, and user testimonials creates a storyline about how AI can support trader decision-making. While the forecasts offer direction and momentum cues, they are intended to complement, not replace, a trader’s own analysis and risk management framework. The invitation to explore a personalized demonstration positions VantagePoint as a practical addition to a trader’s toolkit, especially for those who prioritize data-driven signals and structured trade planning. In sum, the platform’s narrative centers on leveraging AI to anticipate near-term moves and to help traders align their strategies with forward-looking momentum indicators.

Conclusion

VantagePoint Trading Software presents a comprehensive AI-enabled approach to forecasting near-term market movements across multiple asset classes, including stocks like American Airlines (AAL). By integrating end-of-day data with neural network-driven predictions, the platform provides signals intended to help traders time entries and exits with greater confidence. In the case of AAL, a confluence of indicators—a blue predictive crossover above the simple moving average, a neural index moving from RED to GREEN, and forecasted highs and lows suggesting continued strength—frames a bullish view for the near term. Traders may consider a straightforward stock entry around the $40 area with a protective sell-stop near $37.75, as well as a premium debit call spread strategy targeting around $43.50 that leverages a September 21 expiration and a 42/43.5 call spread purchased for about $0.33, with a defined risk of $0.33 and a potential reward of up to $1.17 per spread.

The broader market context, including the narrative of a long-running U.S. bull market and ongoing debates about future direction, underscores the importance of integrating AI-driven insights with disciplined risk management. The S&P 500’s extended ascent over 3,500 days and a more than 320% rise since March 2009 frame the environment in which VantagePoint’s forecasts operate, emphasizing the need for careful interpretation and flexible strategy execution. Traders are encouraged to view AI-generated signals as a directional guide that complements fundamental and technical analysis, rather than a standalone signal set. The promise of AI in forecasting is compelling, and the platform’s approach—grounded in neural networks, predictive indicators, and near-term horizon analyses—offers a structured framework for considering trades in AAL and other assets.

For interested traders, a personalized demonstration can provide deeper insight into how VantagePoint’s AI tools can be integrated into specific trading plans, with attention to risk management, position sizing, and strategy optimization. As AI-driven forecasting becomes increasingly embedded in trading workflows, the ongoing exploration of how best to apply these insights—while maintaining discipline and prudent risk controls—remains essential for achieving consistent outcomes in dynamic markets. The pursuit of improved timing, informed by predictive analytics, continues to be a central objective for traders who rely on data-driven approaches to navigate near-term market movements.