The U.S. dollar strengthened notably after the Federal Reserve delivered a policy outcome that wasn’t as dovish as some traders had priced in, even as it signaled a cautious view on inflation and employment. Concurrently, stock markets rebounded, buoyed by Powell’s remarks on the economy’s resilience and by fresh signals that a potential trade agreement with Britain could be on the horizon. In Britain, investors watched closely as the BoE prepared to announce a rate decision, with expectations centered on a 25 basis point cut, while broad UK data and PMI figures added nuance to the policymakers’ guidance. Across the globe, the day’s moves underscored a shift in risk sentiment: a dollar that benefited from a still-uncertain macro backdrop, equities catching a bid on a mix of optimism and policy discipline, and major central banks mapping out cautious paths forward.

Federal Reserve Decision and the Dollar’s Move

The Federal Reserve’s decision to hold the federal funds target range steady was broadly anticipated, but the accompanying commentary and press conference reinforced a narrative that the committee remains alert to inflation risks and the evolving labor market. Officials acknowledged a pickup in unemployment and highlighted the higher risk environment for inflation, even as Fed Chair Jerome Powell stressed that the overall economy remains solid in the near term. This combination created a nuanced message: policy remains data-dependent, with no immediate rush to ease policy despite the recent softness in some survey indicators of households and businesses.

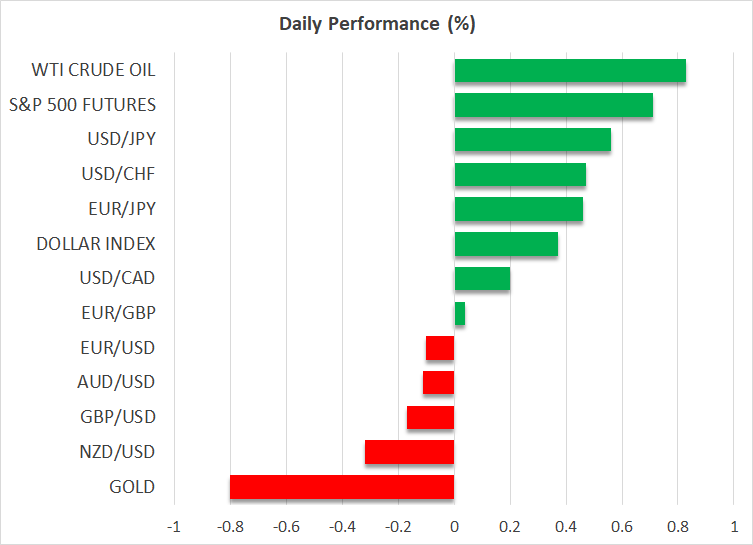

The dollar’s strength in this environment reflected what traders often seek in the face of uncertainty: a credible, data-driven stance from a central bank that underscored the need to see clearer inflation signals before adjusting policy. Against key safe-haven currencies like the Swiss franc and the Japanese yen, the greenback advanced as risk appetite grew on the back of better-than-feared inflation projections and a still-robust labor market. While the dollar’s gains extended relative to some peers, they did not signal a definitive end to the existing downtrend. Market participants remained cautious, recognizing that a potential recession remains on the radar for some strategists, even as sentiment improved briefly in response to comments about a future trade deal.

A central point of the Fed’s communications was the acknowledgment that the path of unemployment has evolved, as did the contours of inflation risks. Powell noted that while the household and business surveys had deteriorated, the broader economy continued to show resilience. The statement stressed vigilance about upside inflation risks and the possibility that price pressures could re-emerge despite evidence of slowing in some components of the inflation index. In this context, futures markets continued to price in a gradual path of rate reductions through the year, signaling a market that expected at least some easing but remained wary about the timing and scale of future moves. The pricing implied a sizable portion of a 75 basis point cumulative easing by year-end, with the market assigning a strong probability—about eight in ten—that a July rate reduction would occur.

In sum, the Fed’s messaging portrayed a cautious but constructive picture: the economy remains solid, but the risk of persistent inflation and a shifting labor market required careful monitoring. This balance helped the dollar maintain its footing, even as investors digest the possibility that accommodative policy could become less necessary than previously anticipated. The net effect on sentiment was a bifurcated response: a stronger dollar reflecting policy credibility and a more measured optimism about the broader risk landscape as investors priced in a cautious but less dovish regime.

Wall Street Gains and Trump’s Trade Signal

Wall Street closed in the green after a volatile session, with the Dow Jones Industrial Average posting the steepest gains of the major indices. A key driver appeared to be Powell’s more optimistic assessment of the U.S. economy than some had anticipated, which helped assuage some concerns about the pace of growth and the durability of the expansion. Markets also weighed reports that President Trump is considering a major trade deal with a large country, with media outlets citing conversations about a forthcoming announcement. The prospect of a significant accord injected a fresh wave of optimism about global trade dynamics and the potential for a more predictable policy backdrop.

In the futures arena, traders looked ahead with the expectation that the narrative could shift further in the coming sessions. A scheduled press event at 14:00 GMT—where Trump was expected to outline the terms of the deal—hung over the market as a focal point for risk sentiment. While the precise partner remained a matter of reporting and speculation, the market’s pricing suggested that even the prospect of a trade agreement could sustain a risk-on tilt. The sentiment benefited equities, with tech and industrial segments often moving in tandem with broader hopes for fewer trade frictions and improved global demand.

Conversations within financial markets also touched on regulatory and policy signals that could influence corporate behavior, investment plans, and capital allocation. The possibility of easing restrictions on certain technologies or sectors could further support gains, particularly in areas where policy alignment is strong and the domestic regulatory environment is perceived as favorable. Traders weighed the potential benefits of a smoother global trade regime against the still-fragile macro backdrop, recognizing that a single headline could provide a temporary boost to risk appetite but that the longer-term trajectory would depend on ongoing economic data and policy developments.

BoE Outlook and the UK Economic Backdrop

As attention shifted toward Britain, the Bank of England was poised to announce its own policy decision. The consensus among analysts was for a 25 basis point cut in the policy rate, underscoring expectations that British borrowing costs would be lowered to support a cooling economy or to manage evolving demand pressures. The emphasis for traders, however, extended beyond the absolute rate move to the forward-looking guidance: how policymakers intended to steer policy in the months ahead, how they assessed the balance of risks to growth and inflation, and what the new projections might reveal about the central bank’s thinking.

In parallel, updated UK data painted a mixed picture. Gross domestic product data released since the prior meeting showed a monthly gain of 0.5% in February, indicating ongoing but uneven growth momentum. Inflation remained stubbornly above the BoE’s 2% target, underscoring the challenge of anchoring price pressures in a scenario of domestic demand and external price dynamics that could be volatile. The April PMIs added a further layer of complexity, with the composite index moving into contractionary territory. The deterioration in the PMIs pointed to heightened uncertainty among businesses in the wake of policy shifts and global trade tensions, including the broader appetite for “Liberation Day” that had been mentioned in political discourse and commentary.

Although the PMIs suggested that there could be room for a rate cut today, the broader macro narrative did not necessarily align with the most dovish bets for the remainder of the year. Markets continued to price in further reductions beyond today’s move, with expectations for an additional 75 basis points of cuts over the ensuing period. Yet investors also considered whether the UK economy could withstand these shifts without tipping into a deeper slowdown, given inflation dynamics and external demand conditions. The more cautious or less dovish tilt in today’s communication could, in turn, support the pound if Governor Andrew Bailey’s remarks reinforced the view that the economy was not tipping toward a recession and that policy would be calibrated in a way that avoided excessive easing.

Bailey’s recent comments that the UK economy is not near recession provided a counterbalance to concerns that a faster or more aggressive easing cycle might be warranted. If the Bank leaned toward a more moderate path—recognizing resilient activity in some sectors and inflation that remained above target—the pound could drift higher against major peers, especially if investors interpreted the guidance as signaling fewer emergency-style policy responses and a more stable medium-term outlook. The interaction between UK data, policy signals, and global rate expectations would continue to shape currency and cross-asset dynamics as the BoE’s decision approached and as observers parsed the central bank’s projections and the tone of its communications.

Market Dynamics: Inflation, Labor Markets, and Rate-Path Expectations

Across markets, a central theme remained the recalibration of expectations around inflation trajectories, the labor market, and the pace at which central banks would ease policy, if at all, in response. The Fed’s emphasis on inflation risk and the existing degree of uncertainty around household and business sentiment contributed to a cautious stance among investors who are contemplating the ultimate path of monetary policy in the United States. Meanwhile, rate-cut expectations reflected a balancing act: traders were pricing in a less aggressive easing cycle than earlier anticipated, but the mere possibility of a sequence of cuts remained, given the evolving risk environment and the potential for renewed concerns about the growth outlook.

The broader risk sentiment also reflected a nuanced calculus surrounding global trade. Trump’s remarks and the market’s interpretation of those statements contributed to a temporary improvement in risk appetite, as investors anticipated fewer trade barriers and greater collaboration among major economies. The potential deal, especially if it involved a large partner such as Britain, would have implications for supply chains, investment decisions, and corporate earnings. Market participants weighed the probability of a more favorable trade environment against the risk of policy missteps or geopolitical tensions that could reintroduce volatility.

In addition, investors continued to monitor the performance of currencies considered safe-haven assets during periods of heightened uncertainty. The yen and the Swiss franc often traded in response to shifting risk sentiment, with divergences in policy outlook between major central banks influencing FX markets. Sentiment shifts could also affect the timing and magnitude of capital flows into or out of risk assets, including equities and corporate bonds, as investors sought to optimize risk-adjusted returns amid a dynamic policy landscape.

Investor Sentiment, Risk Appetite, and Cross-Asset Implications

The day’s developments underscored how delicate the balance remains between risk-on and risk-off dynamics. Positive signals about a potential trade deal and a solid economic backdrop could push investors toward equities and cyclicals, taking advantage of a more favorable global growth environment. Yet the persistence of inflation risks and possible policy normalization by the Fed kept some investors cautious, guarding against a renewed acceleration in price pressures or a slower-than-expected improvement in labor market dynamics.

From a portfolio perspective, the implications were clear: diversification across asset classes remains critical, as does attention to the timing of rate moves and the potential for policy surprises. Fixed income investors continued to scrutinize the curve for indications of changing expectations about the pace of monetary tightening or easing, while equity investors weighed sectoral exposure, with technology, industrials, and financials likely to respond differently to evolving macro signals. The currency market’s response to policy expectations also informed hedging and positioning decisions, as traders sought to manage currency risk while capitalizing on potential mispricings in cross-border flows.

Overall, the market environment remained complex and multi-dimensional. The Fed’s stance suggested a careful approach to policy normalization amid inflation uncertainty, while the BoE’s path hinged on domestic data and the strength of external demand. The prospect of a meaningful trade deal added a further layer of optimism, potentially shaping the trajectory of global growth and corporate profits in ways that could sustain a cautious but constructive risk appetite in the near term.

Strategic Takeaways for Traders and Investors

In light of the day’s developments, several strategic considerations emerge for market participants:

-

Policy sensitivity and data dependence: Market participants should remain vigilant for shifts in inflation indicators, labor market signals, and the central banks’ communications in the coming weeks. The trajectory of rate expectations will hinge on incoming data, and any surprises could catalyze rapid repricing across FX, rates, and equities.

-

Trade policy as a growth catalyst: A potential trade deal with a major partner can alter the global demand outlook, underpinning risk assets if coupled with clarity on terms and enforcement. Investors should assess sectoral exposure to trade dynamics, including exposure in industrials, technology, and consumer discretionary sectors, which could bear the brunt or benefit the most from a more predictable trade environment.

-

Currency positioning: With the dollar trading as a focal point in response to policy expectations, currency hedging remains essential for portfolios with international exposure. Traders should monitor currency correlations with risk sentiment and policy expectations, adjusting hedges as the macro narrative evolves.

-

Sector rotation and earnings visibility: As the macro backdrop evolves, sector performance may rotate based on perceived earnings visibility and exposure to international markets. Investors should scrutinize earnings forecasts, margins, and exposure to global demand when constructing diversified portfolios.

-

Risk management and scenario planning: Given the potential for sudden policy pivots or geopolitical headlines, maintaining robust risk controls, stop levels, and liquidity management will be crucial. Scenario planning that considers different paths for inflation, growth, and policy could enhance resilience and adaptability.

Conclusion

The day’s market movements reflected a careful dance between policy signals, inflation risk, and evolving trade expectations. The U.S. dollar strengthened against traditional safe-haven counterparts as the Fed underscored the need for vigilance around inflation and the labor market, while Powell’s comments suggested resilience in the economy that could inform a measured approach to future policy adjustments. Simultaneously, equity markets found support from optimism about a broader trade deal and a more constructive near-term policy outlook, even as traders remained mindful of potential risks.

In Britain, the BoE’s anticipated 25 basis point rate cut anchored attention on forward guidance and the central bank’s projections, with UK data underscoring inflation challenges and the uncertainties surrounding growth. The evolving mix of domestic data and global policy expectations highlighted how interconnected markets have become; central banks’ projections, trade developments, and risk sentiment continue to shape currency moves, fixed income pathways, and equity valuations across regions.

Looking ahead, investors and traders will closely monitor incoming inflation data, unemployment trends, and the evolving stance of major central banks. The balance between supportive policy and inflation containment will likely drive volatility and opportunities across asset classes. As credit markets digest rate-path expectations and as geopolitical headlines introduce fresh risk factors, the path for the dollar, stocks, and rates will remain a focal point for market participants seeking to navigate an ever-changing macro landscape.